The Why? What? Where? & How? Explained...

1. Why Investment Property? Appreciation & Net Profit

Why do you want to buy an investment property?

Well for more money of course! This breaks down into a profit you will make from the rental income (net profit) and appreciation you will make when you sell the property in the future.

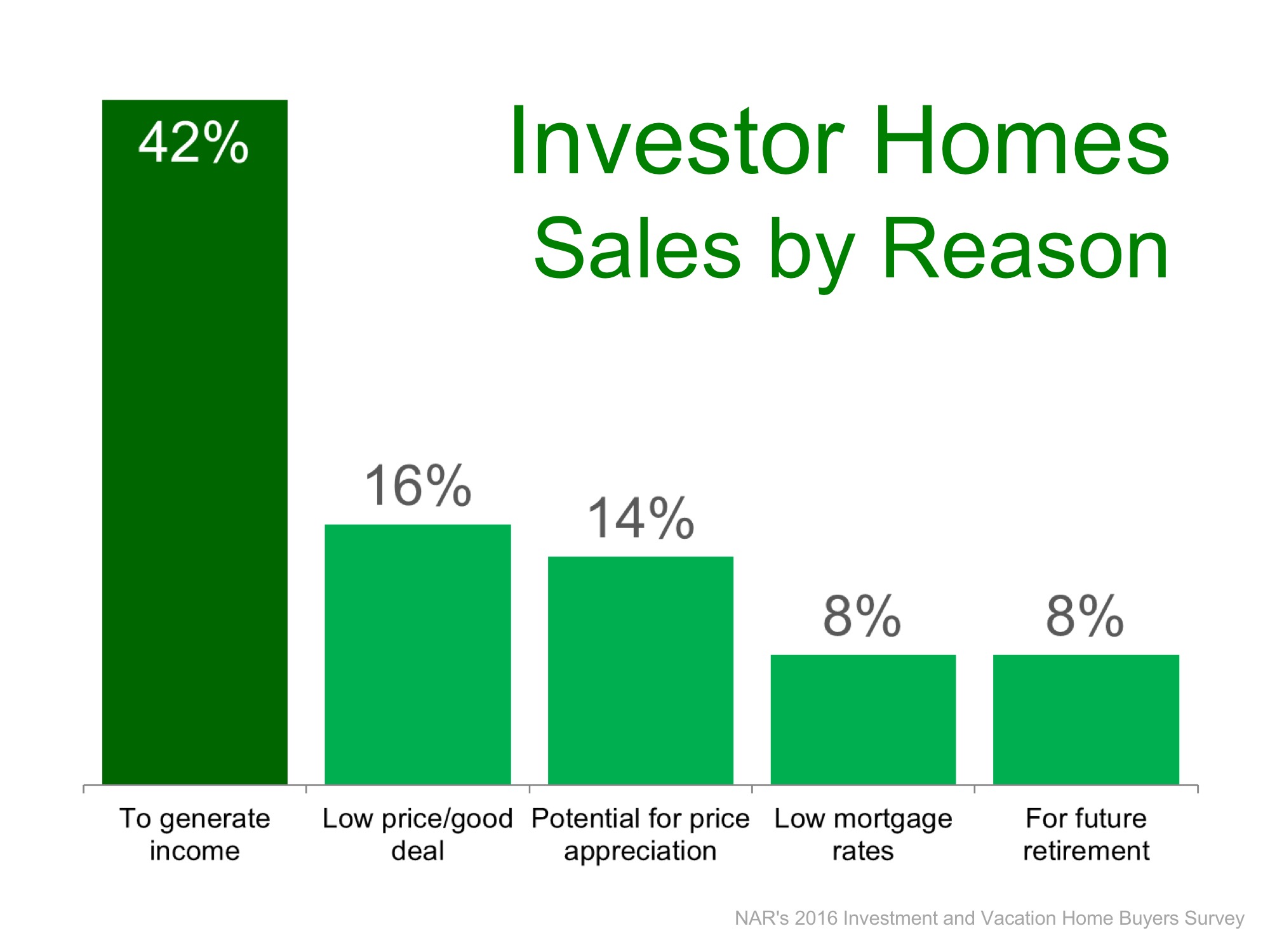

Reasons why people purchased investment properties:

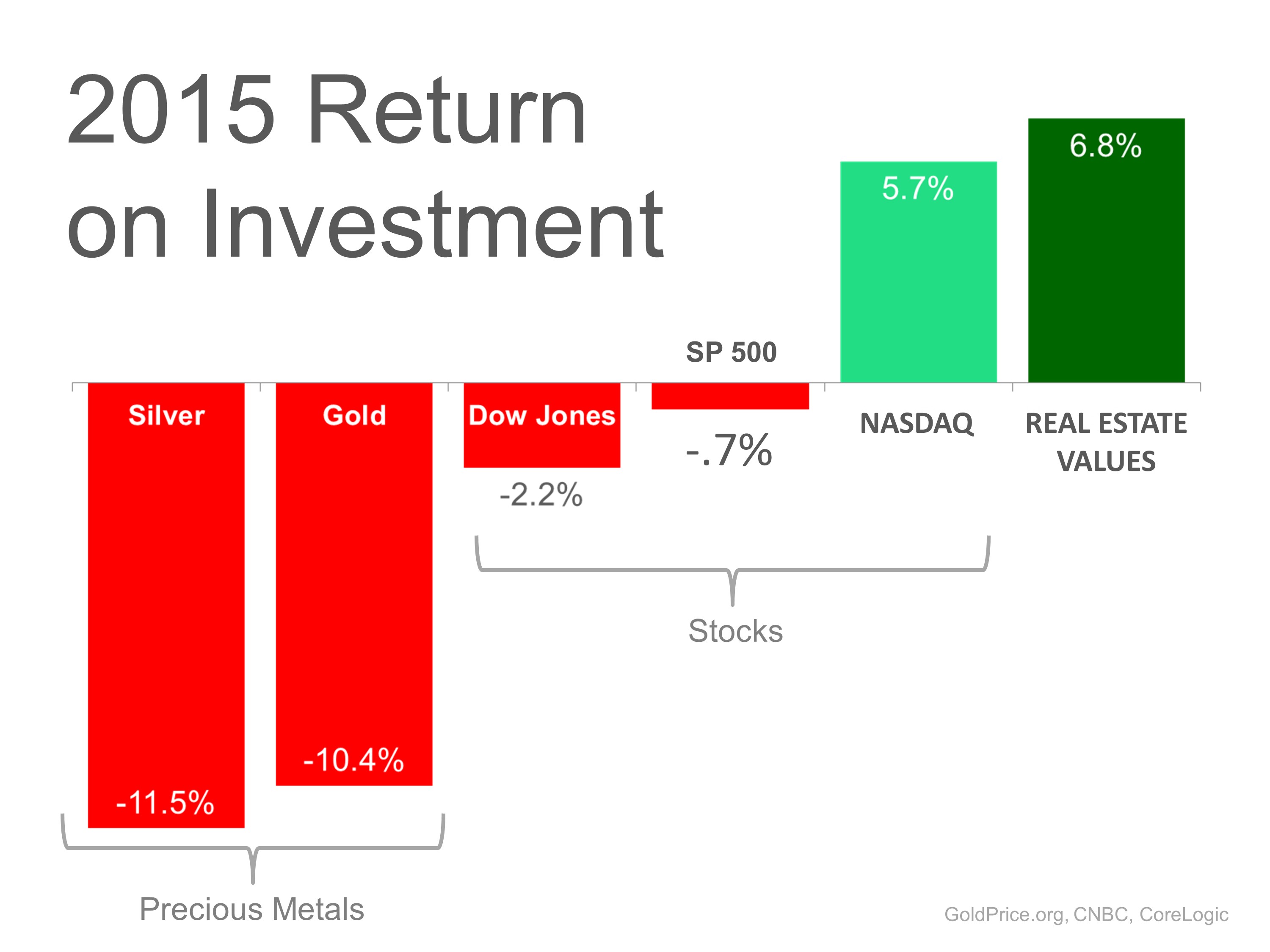

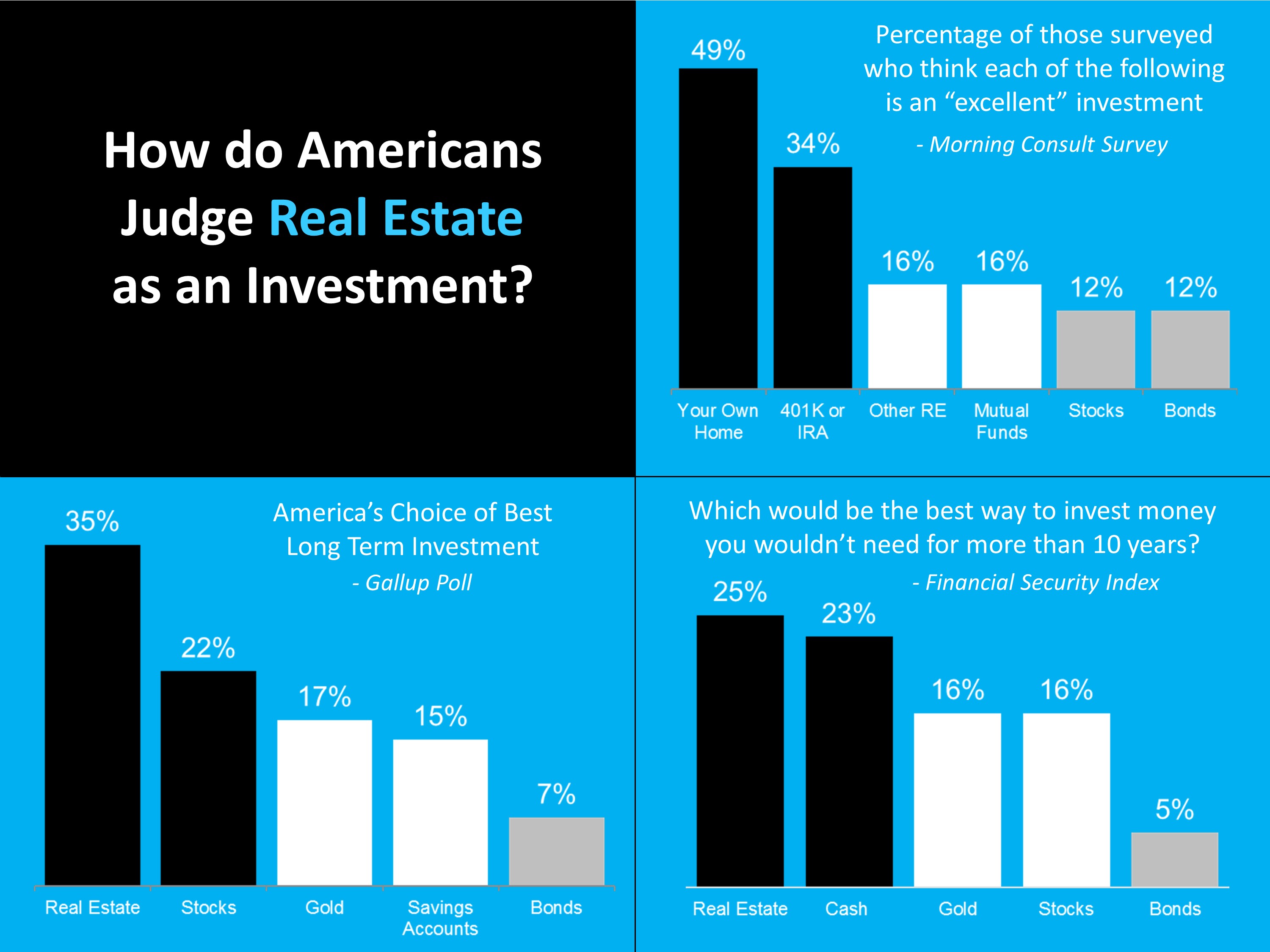

In 2015 Real Estate return on the investment was the top money maker!

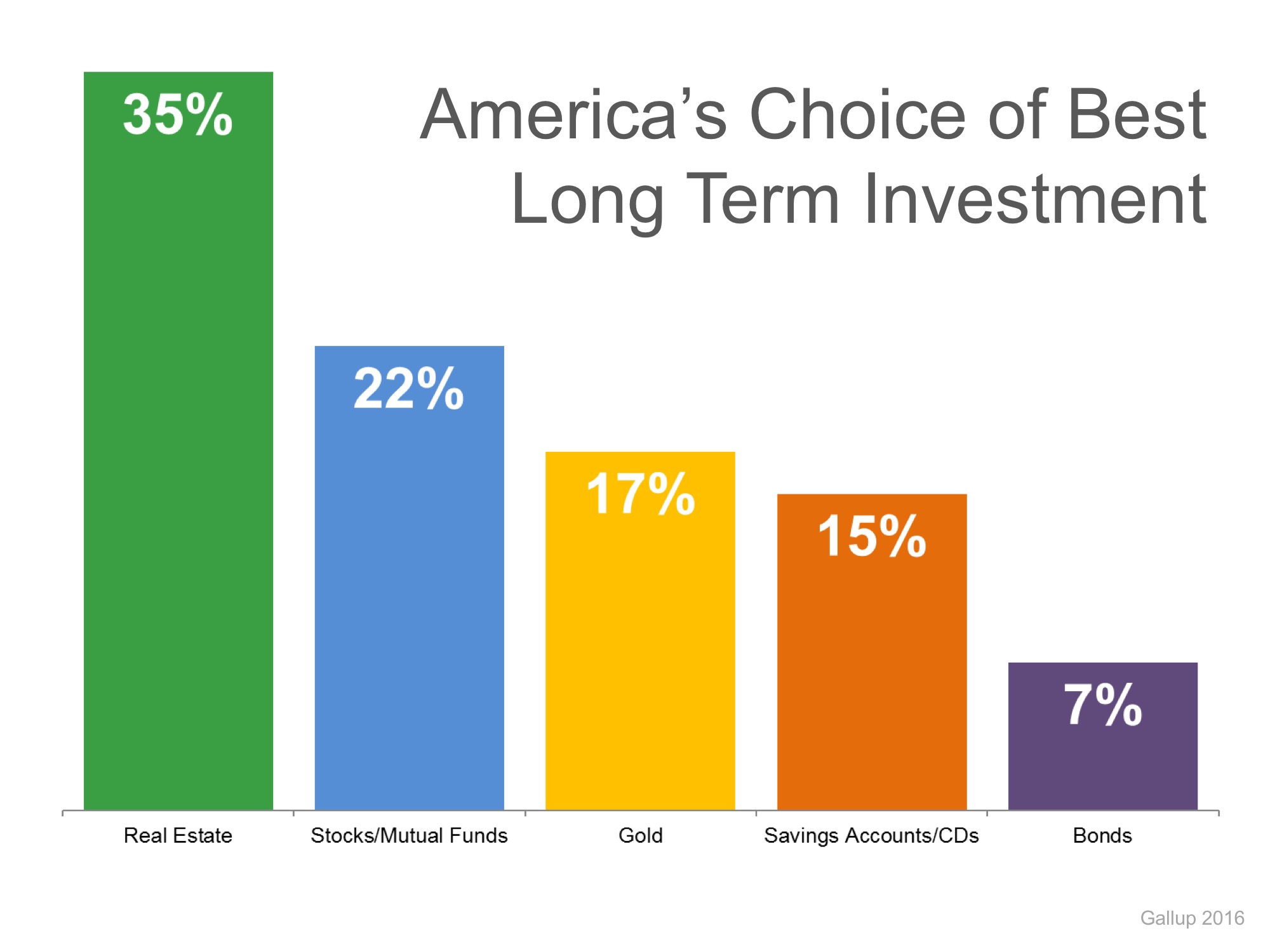

That is why real estate has been ranked the top long term investment:

That is why this chief economist says to buy:

Appreciation

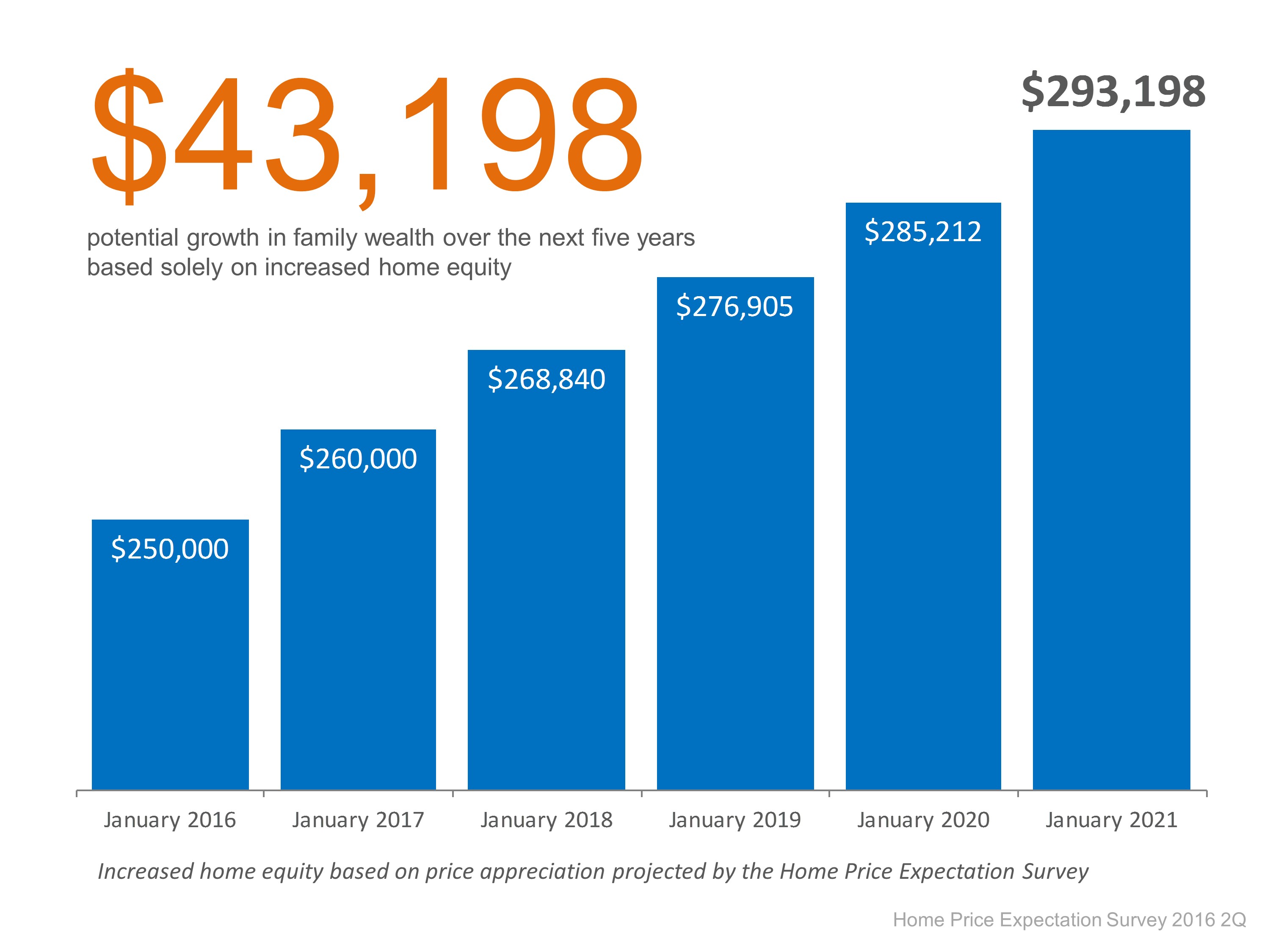

Here is the forecasted appreciation from investing in Real Estate on a $250,000 property:

In choosing a property to invest in you are going to have to compare the appreciation and rental income of properties in different areas. The appreciation is highly determined by the area and neighborhood of the property. As a Realtor, I can pull the appreciation rates of zip codes or neighborhoods to show you which areas have a history of better appreciation.

In our area, the Southside, Intracoastal West, Beaches, Nocatee and St. Johns County properties are all highly desired. However, because of the average cost of a property at the Beaches, these properties will lend more toward appreciation than net profit. And the typical rule of thumb is as you get further away from the beach the more net profit potential you will have. We can look at historical appreciation rates to forecast future values. And we can crunch numbers on current carrying cost and rent payments to see your net profit.

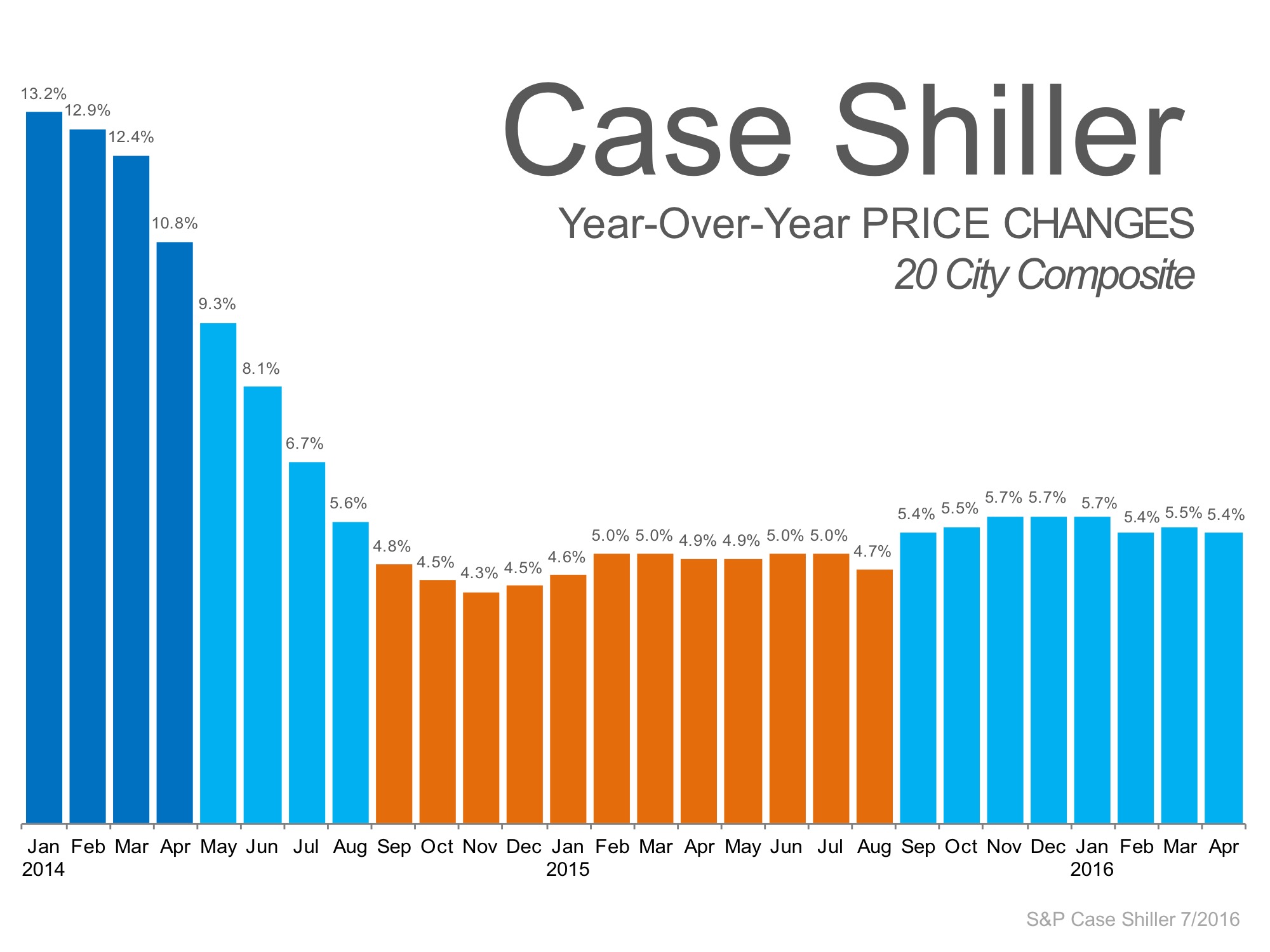

We have been seeing over 5% appreciation in the real estate market:

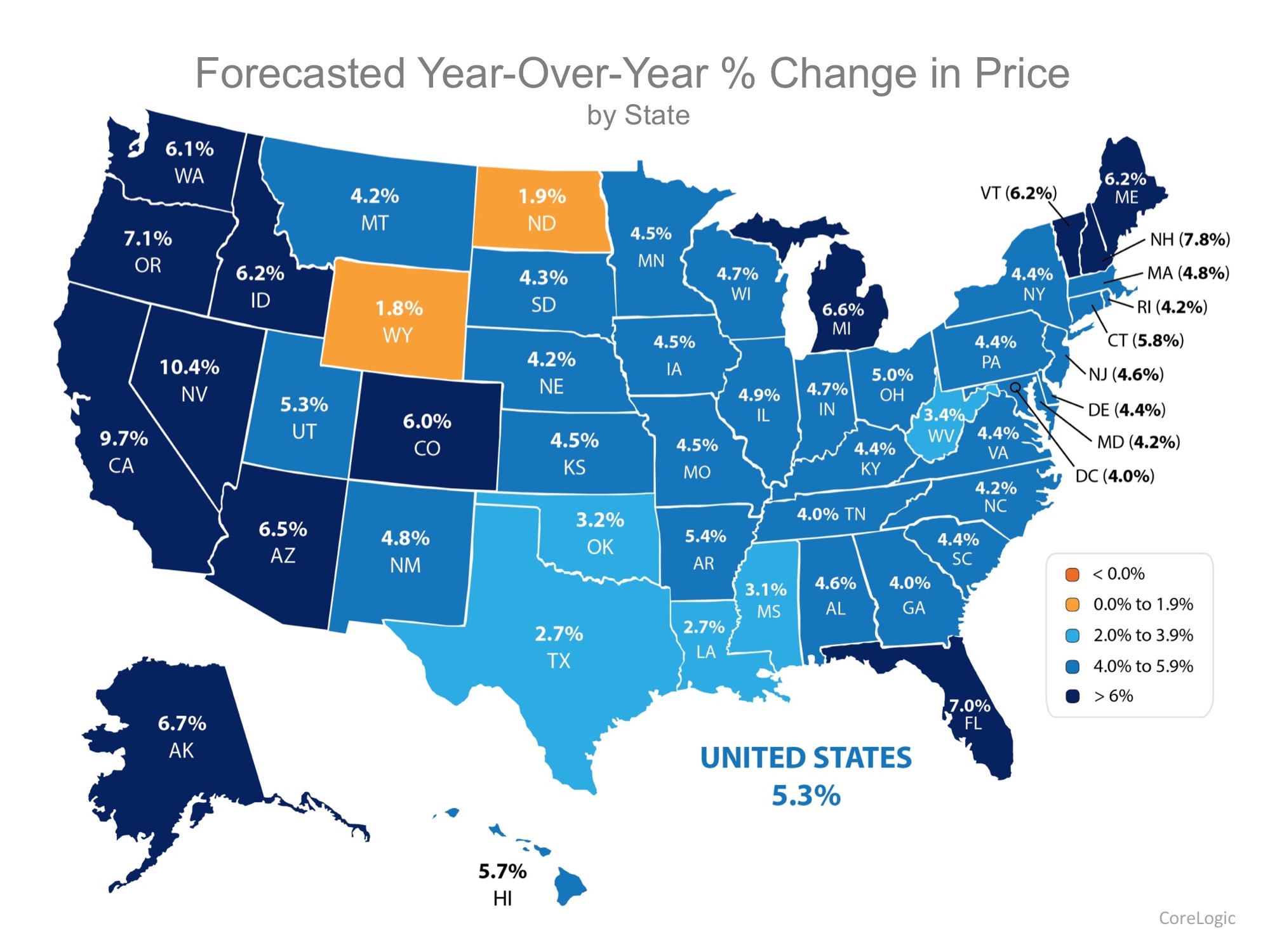

Price appreciation forecast for next year:

The reason for the positive forecast is a shortage of homes leading to a higher demand:

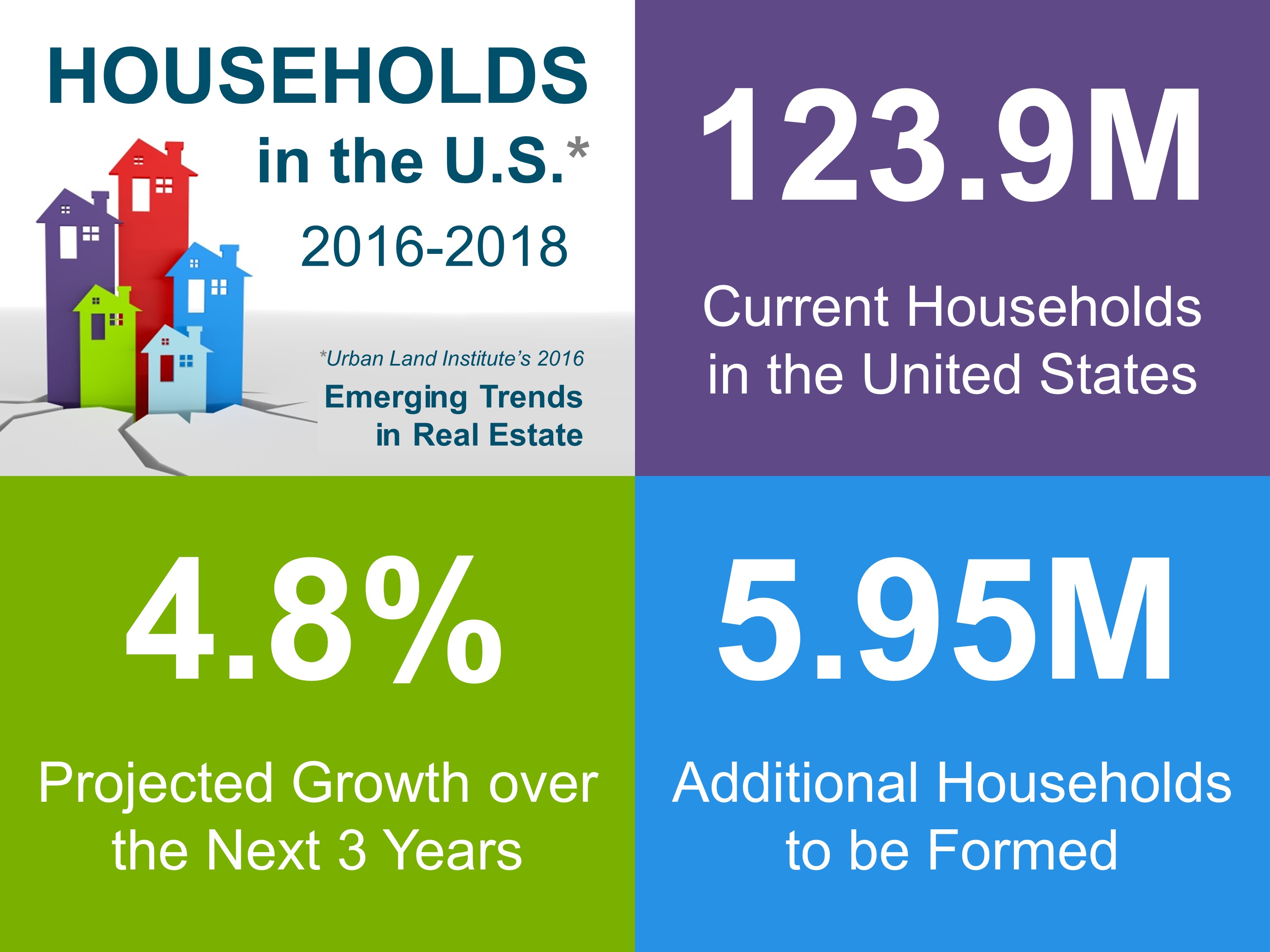

And we are seeing an increase in demand due to household growth:

Net Profit

Net profit is easy to forecast for you. As a Realtor, once I know how you are going to pay for the property I can work up your estimated monthly cost for the home (mortgage payment, condo fees, insurance, etc). Then I can do a market analysis on the rental side to give an estimated rental amount and how quickly it should rent. With these figures you can see your net profit and calculate your cash on cash return for your investment.

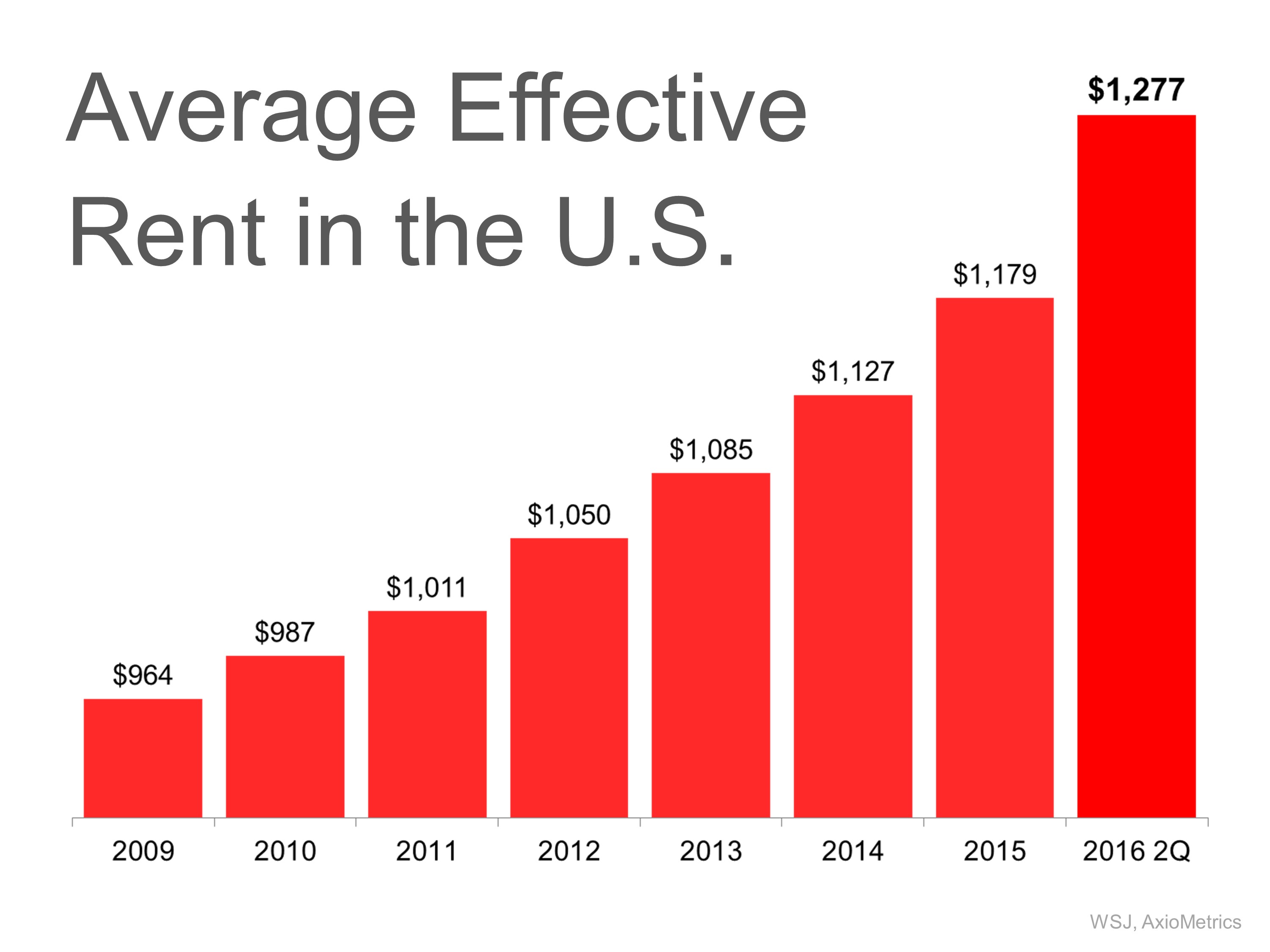

And your net profit on real estate is projected to keep increasing:

Choosing a Property

Once you have your estimated appreciation and your net profit then you can choose which property is best for you. If you have multiple properties that are similar in returns then you just need to focus on the properties as a “normal” home buyer. Which one has the better location? Better schools? Better floor plan? Better lot? Etc. Your Realtor will be able to easily narrow down these choices for you.

Another Reason to Buy Investment Property: For Your Future Use

We have many real estate buyers who are looking to retire in the future in our most popular area, The Beaches, and looking for a property now to do so. Their thoughts are that they either try to use the property partially now for a vacation or two or they plan on renting out the property until it is paid down; then moving into it.

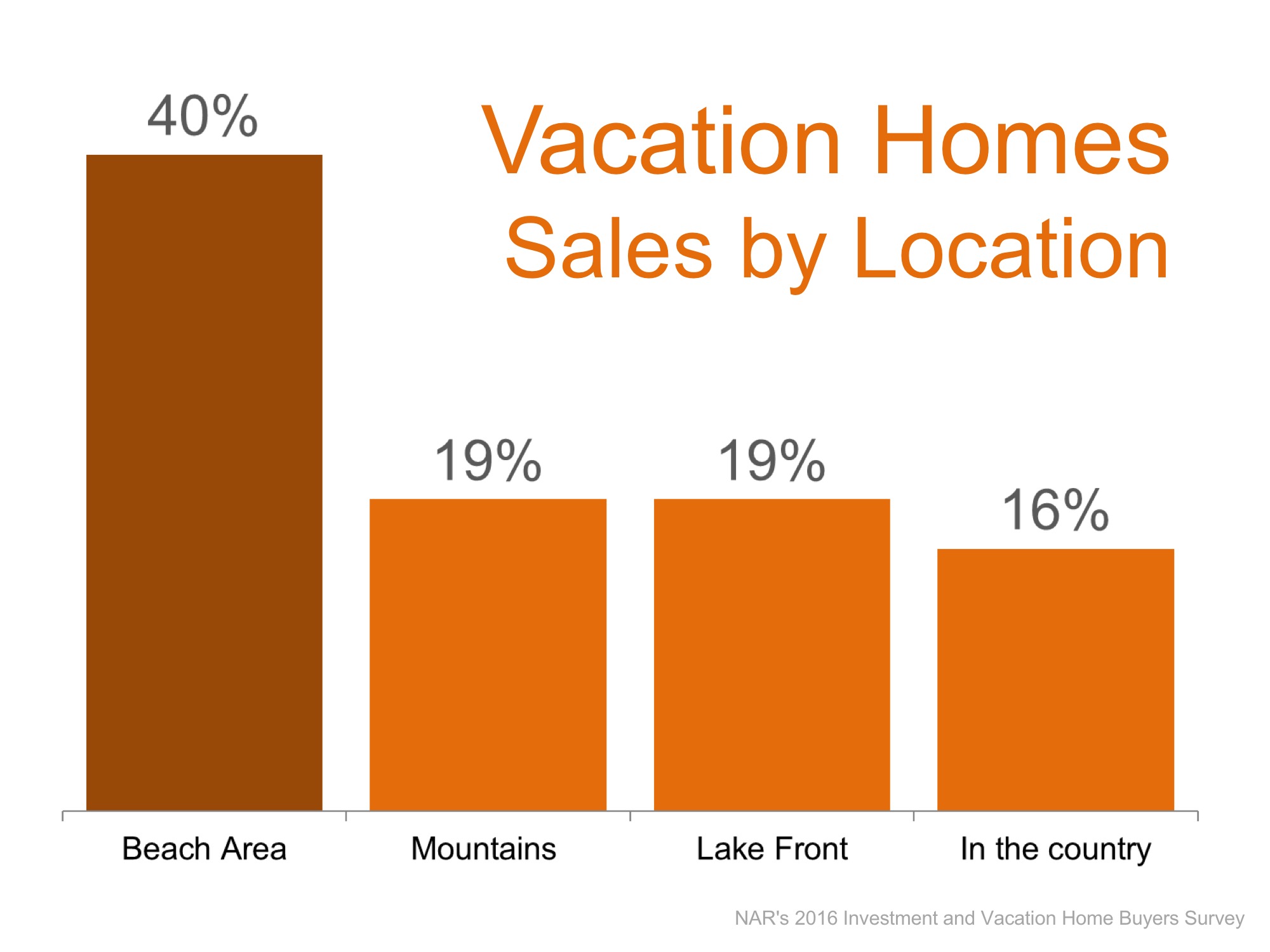

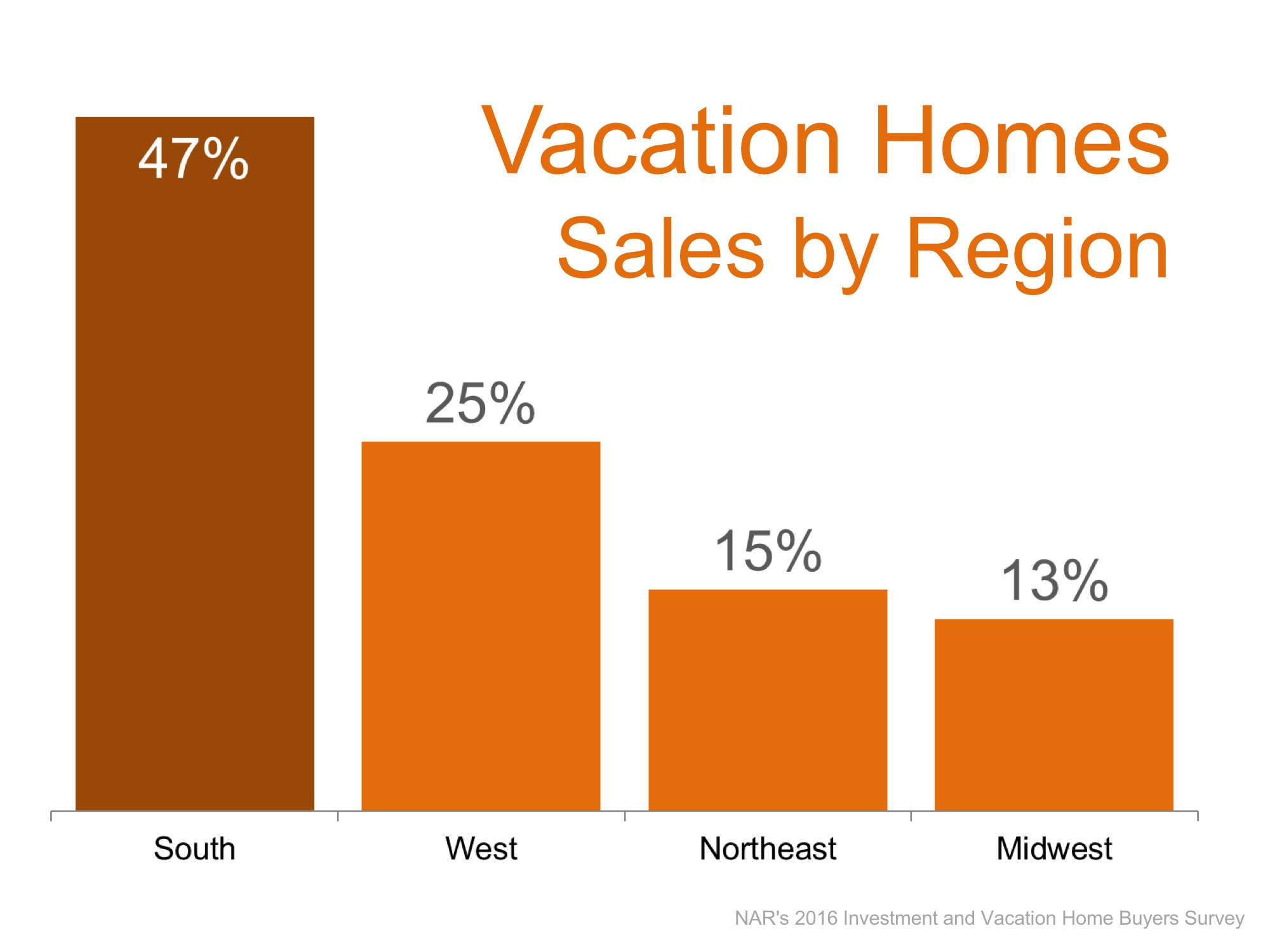

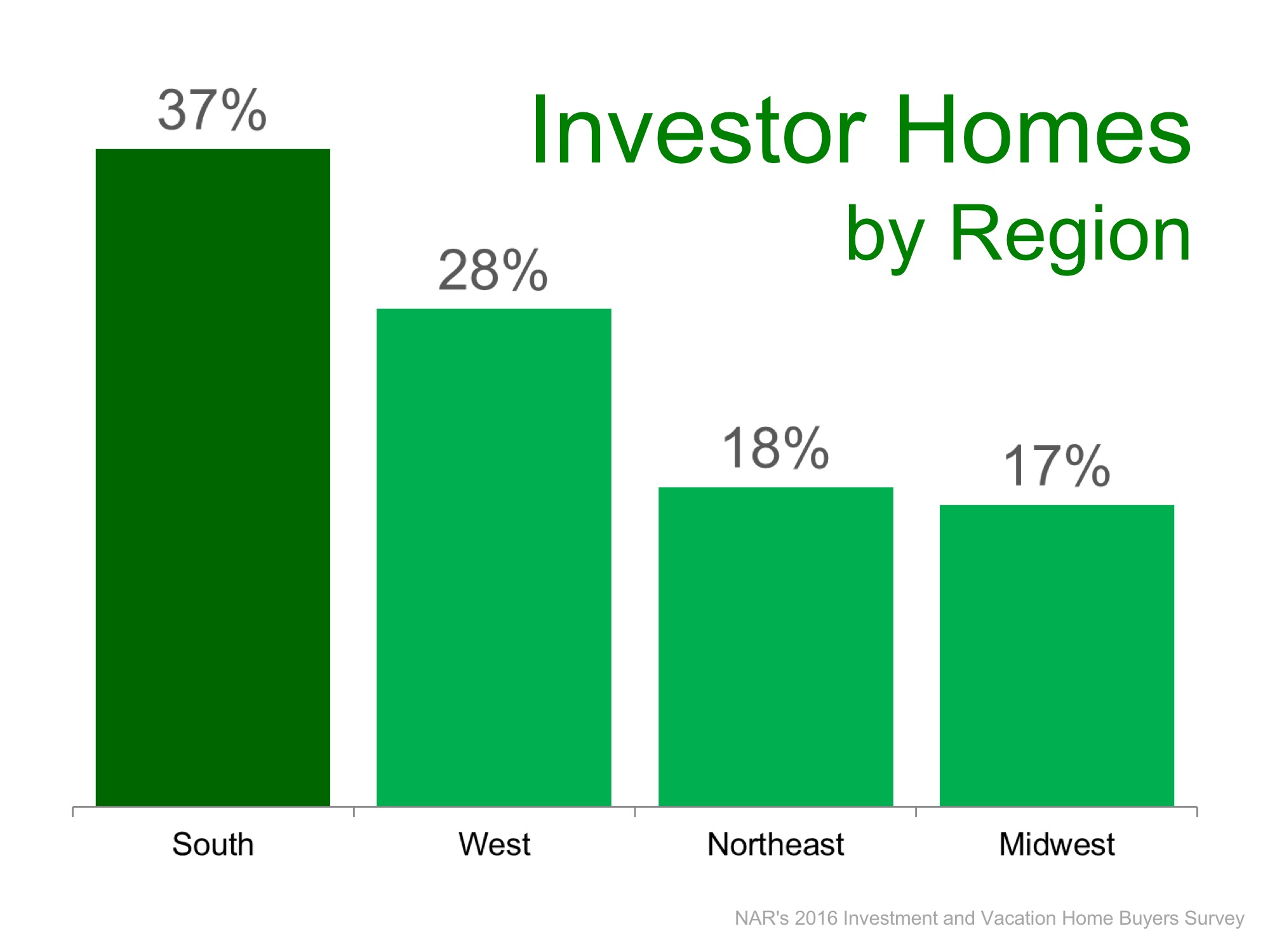

The most popular vacation property in the United States is at the Beach in the South:

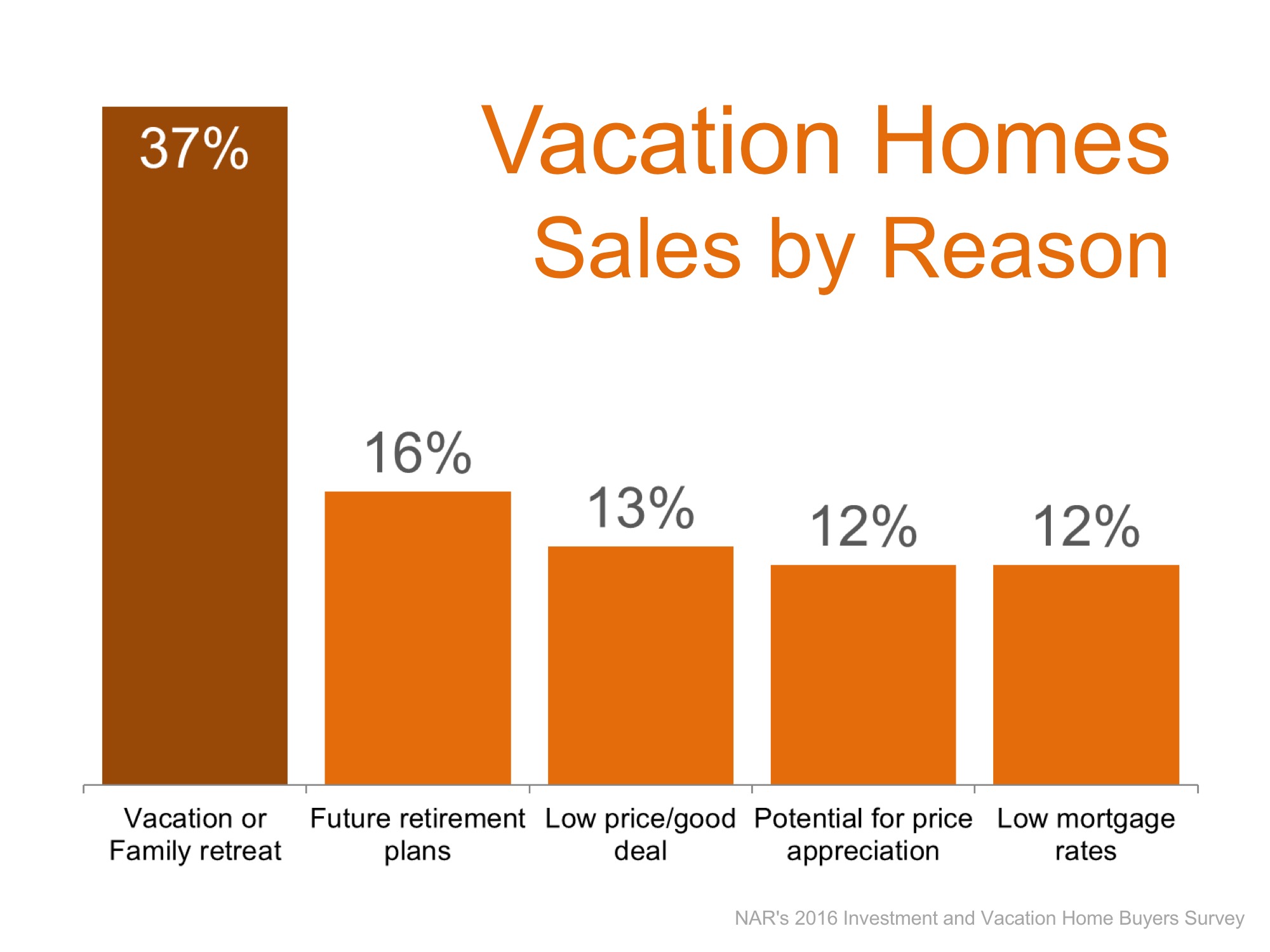

Right now we have seen an increase of people buying for another reason right now. They know real estate prices are still low right now and so are interest rates; so they are taking advantage of the fact by locking those in.

If you do decide you want to use the property part of the year then the home search does get more involved. After all, just picking a property and deciding it will be a vacation rental is not the right way to do it. You have to consider (1) are you allowed to rent the property short term? and (2) is this a property that people will want to rent short term?

There are all types of short term rentals around but the best vacation rentals are those close to the ocean. Otherwise, you maybe seeking a non-vacation tenant such as a corporate client who is coming in for a couple months for a job.

In our area, we see many people seeking oceanfront condos in Jacksonville Beach for a vacation rental. Unfortunately, there are only a handful of buildings that allow vacation rentals. And those typically are the older buildings with smaller units. And even then, you have all different limitations. Some allow daily rentals, other weekly, bi-weekly, monthly, etc. So if you are looking for a larger living space it might more sense to consider a single family home East of 3rd street where there are no rental restrictions.

Future Occupancy Advantages

We have many clients from up north that buy a home or condo at the beach with the future plans to move in to the home. You have the benefit of income, depreciation on your taxes and finally when you move into the property as your primary residence then you can potentially bypass capital gains* (This is not tax advice. Please consult your cpa, attorney, etc.)

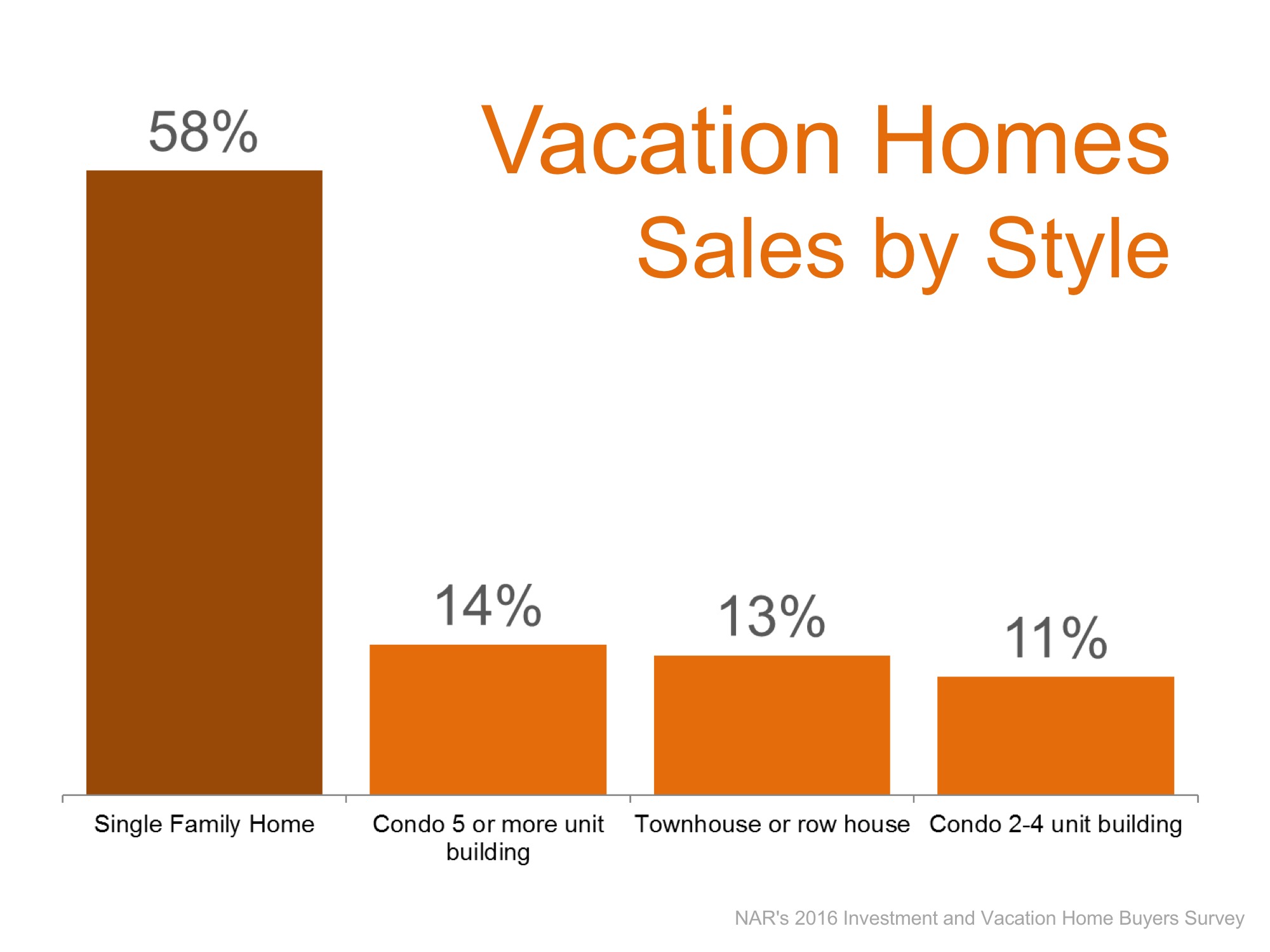

Why people have bought vacation homes:

2. What Property Type? Choosing a Home vs. Condo/Townhome

In considering an investment you are always watching your bottom line. As such, I have seen investor balk at condos because of the mandatory condo fee each month. On the face of things avoiding a mandatory monthly fee seems like it makes sense. In addition, with a condo or townhome you can have a special assessment voted in by the board that you would be obligated to pay.

So does that mean you should consider a condo for an investment property? Not at all.

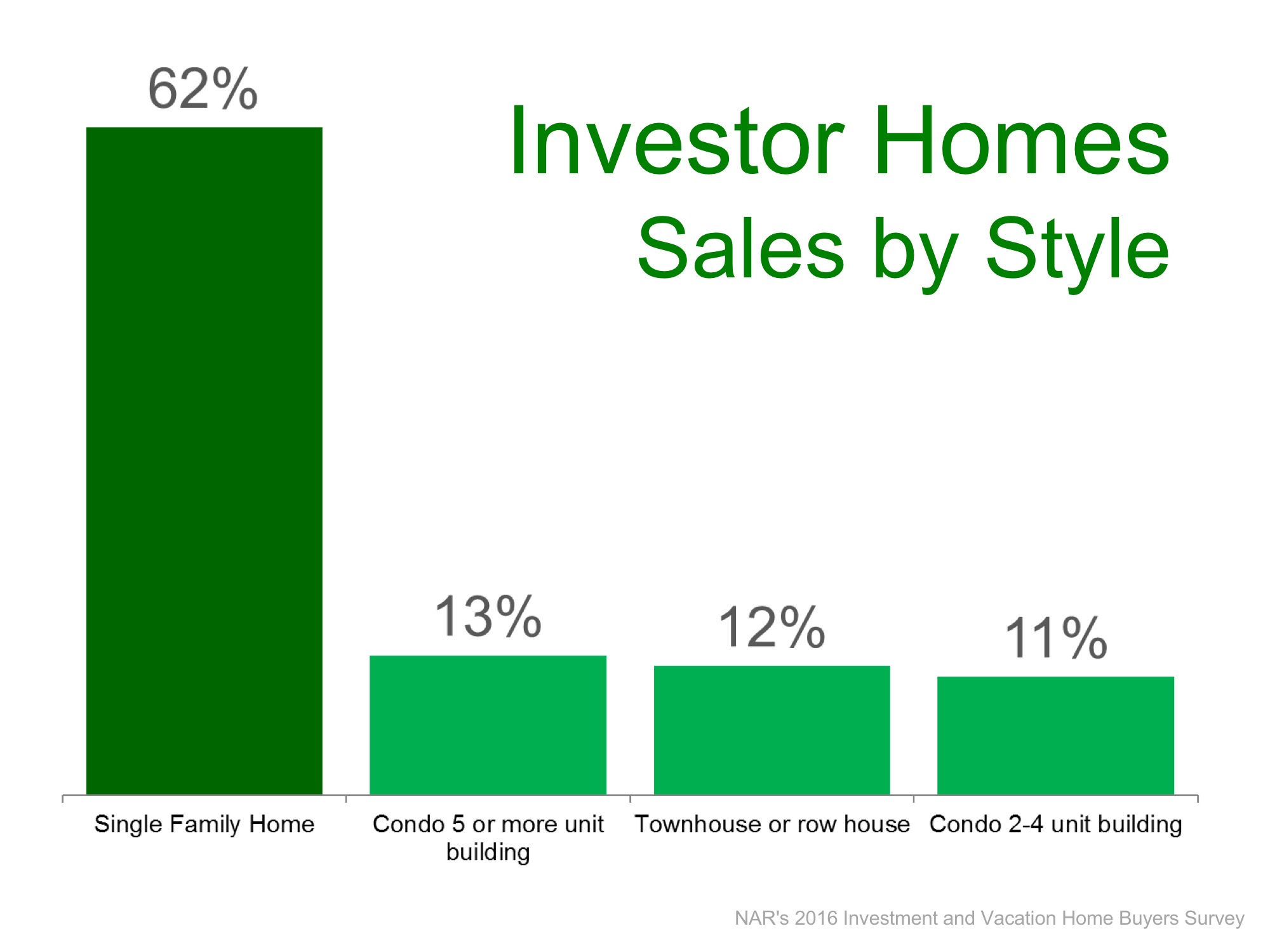

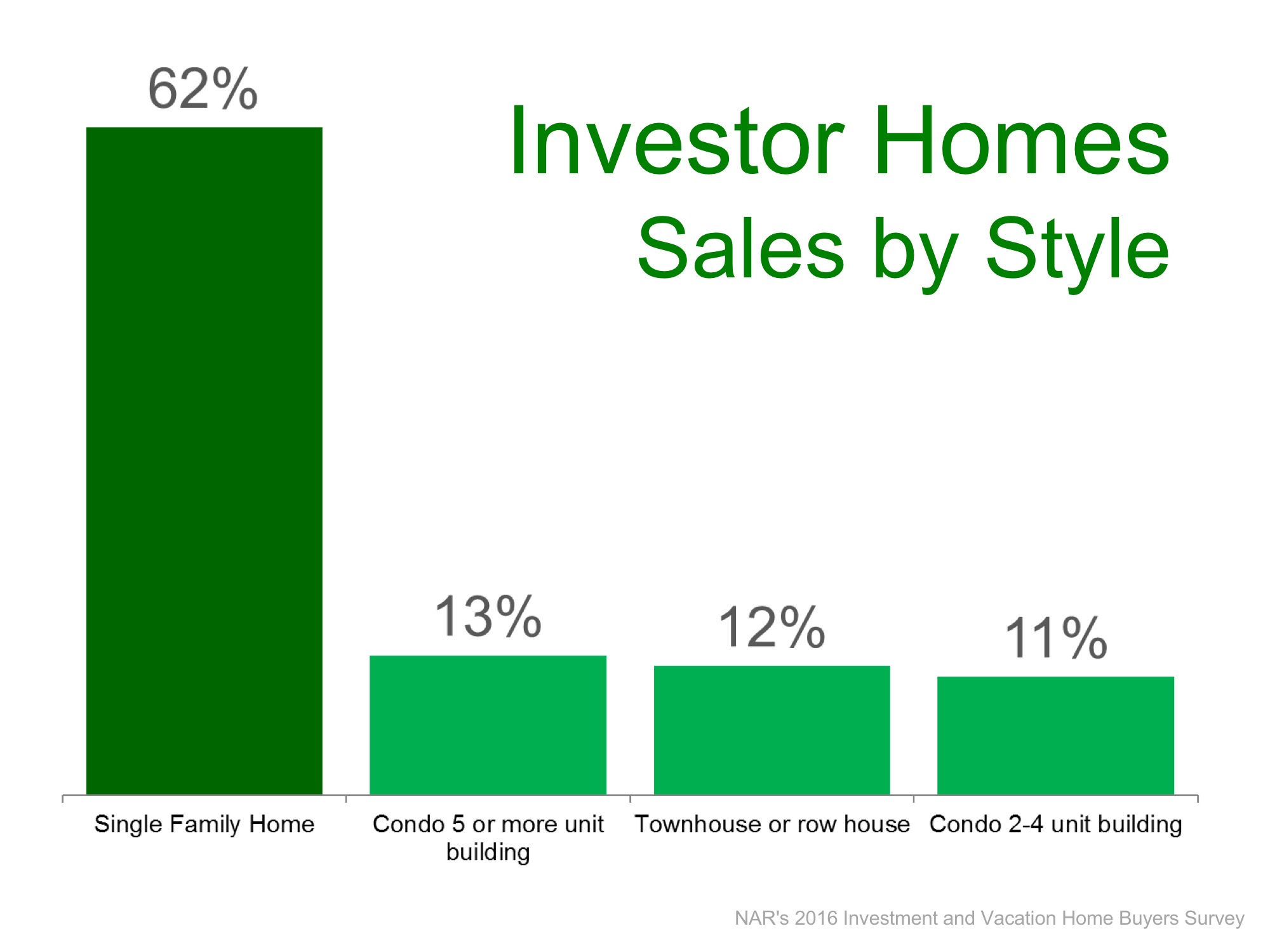

Condos/Townhomes are some of the most popular investment property choices out there.

Let’s break down why a mandatory monthly condo fee isn’t that bad…

Condo/Townhomes Fees

What you need to realize is that condo/townhome fees include building insurance, maintenance of amenities and sometimes utilities.

-So you only need interior insurance to cover the drywall, windows, doors, appliances, cabinets, etc. This is much, much more affordable than home owner insurance. (Please verify in your Townhome community. Some Townhomes can be like a single family home and the fee only covers the amenities and lawn maintenance)

-Utilities such as water and sewer being included in the condo fee is common. (Not as much in a townhome). Sometimes you will find basic cable & internet included also.

So excluding condos and townhomes based on the fact that you don’t like a condo/townhome fee isn’t as straight forward as it seems. A good deal of the items included in the condo/townhome fee you have to pay for when you own a home.

So it comes down to crunching your net profit and not ruling out condos or townhomes just because they have a fee.

Don’t forget the condo/townhome fee also pays for the amenities of the neighborhood. For certain buyers these amenities are must have and mean that your property might rent out faster or for more money.

Special Assessments

If the condos or townhomes are older then there is good chance that sometime in the future that there might be a special assessment for exterior work such as painting & roofing work.

But please be aware these are items that you would have to also do on your home. You just have more control over the work when it is your home.

Maintenance

I mentioned earlier that condos and townhomes were extremely popular investment. The reason that investors overwhelmingly choose condos and townhomes is to have lower maintenance concerns. The lawn and exterior of the building (walls and roof) are taken care of by the condo (and some townhomes). So that is one less thing you have to make sure the tenant maintains.

Tenant Problems

In comparing homes versus condos/townhomes you can run into problems in condos and townhomes if your tenant is a nuisance to the other neighbors. This is less likely to happen in a home (but not impossible). This could be anything from being loud at night, barking dog or stomping on the floor (in a condo only). This can mostly be solved by vetting the tenants before they move in. But there is no guarantee. Also, in more solidly built condos/townhomes (concrete block) you are less likely to find noise nuisance problems between neighbors.

Location

Another reason so many investors buy condos or a townhomes as investment is because condos and townhomes in a desirable location are usually much more affordable than housing. So you can get in a highly desirable areas which means good appreciation and shorter rental times at a lower cost.

For example in our area, in Ponte Vedra Beach single family homes start around $300k and the average house is closer to $1,000,000. However, you can find 1 bedroom condos starting around $90,000! And those have rented out in little as a week! (There are not any townhomes in Ponte Vedra Beach proper. There are condos that have floor plans that make them townhome like).

3. Where to Invest?

In considering an investment property you want to buy a property where people want to live. Or in other words where demand for housing is high.

In Northeast Florida, the beaches are some of the most popular areas to live. You have everything from:

-Atlantic Beach with many properties walking distance to the beach

-Jacksonville Beach with it’s many oceanfront condos

-Ponte Vedra Beach with it’s country club atmosphere and A Rated Schools

Cost

What you will find is the most popular area in town will be the most expensive. So in the most popular area your cost will be higher. However, on the flip side these areas will usually give you the best appreciation.

Properties

In trying to make the numbers work in the most popular areas (most expensive areas) you will find that means you are usually going to end up looking at condos and townhomes. There may be some homes that will work … but those homes tend to be older. So if they have not been remodeled there may be upkeep cost with the roof, hvac, appliances, etc. If you are handy or have a good handyman then it may make sense. If not, you may consider crunching the numbers on a house that already has had the major components updated.

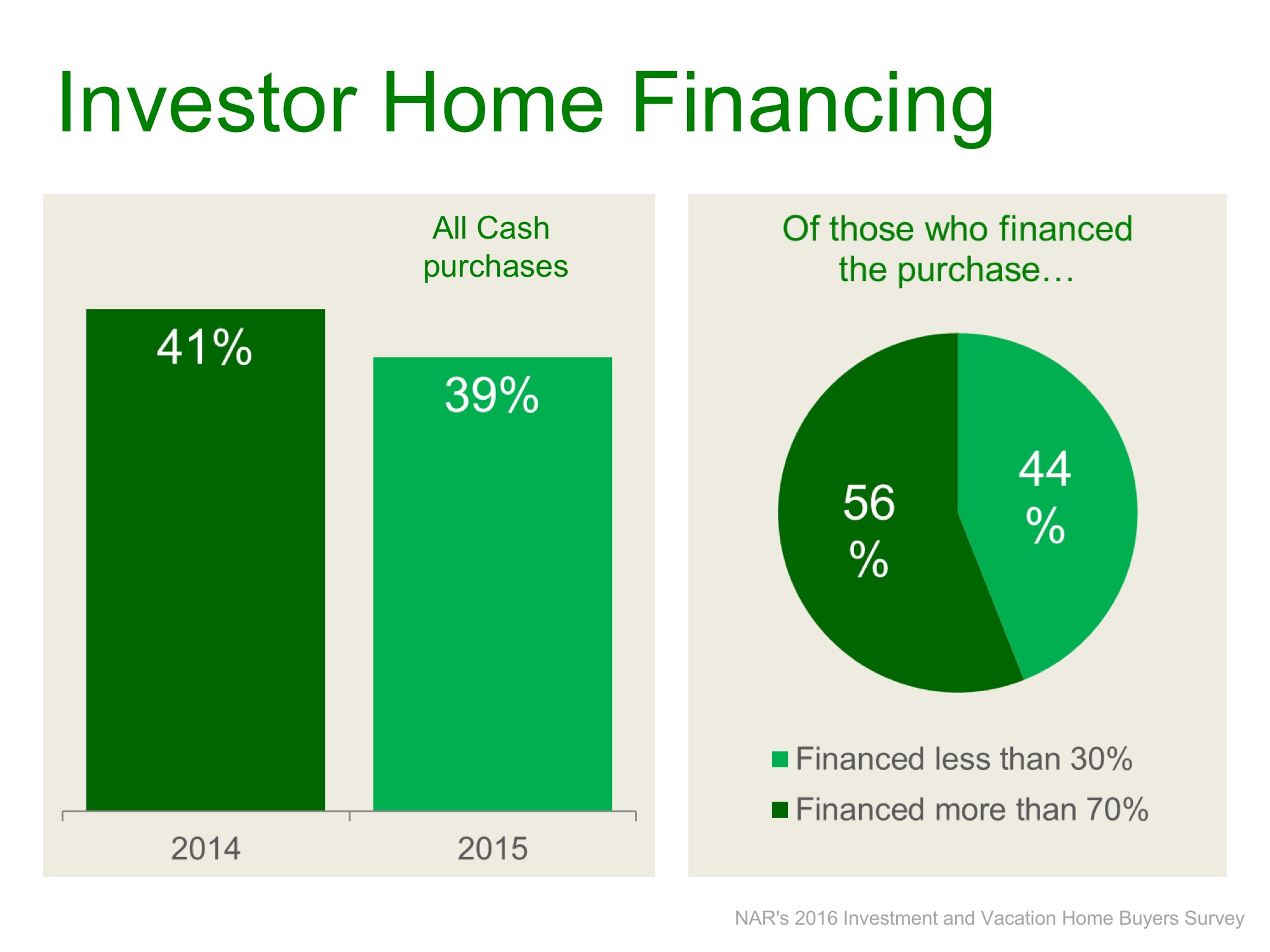

4. How to Invest in Investment Property? Financing vs. Cash

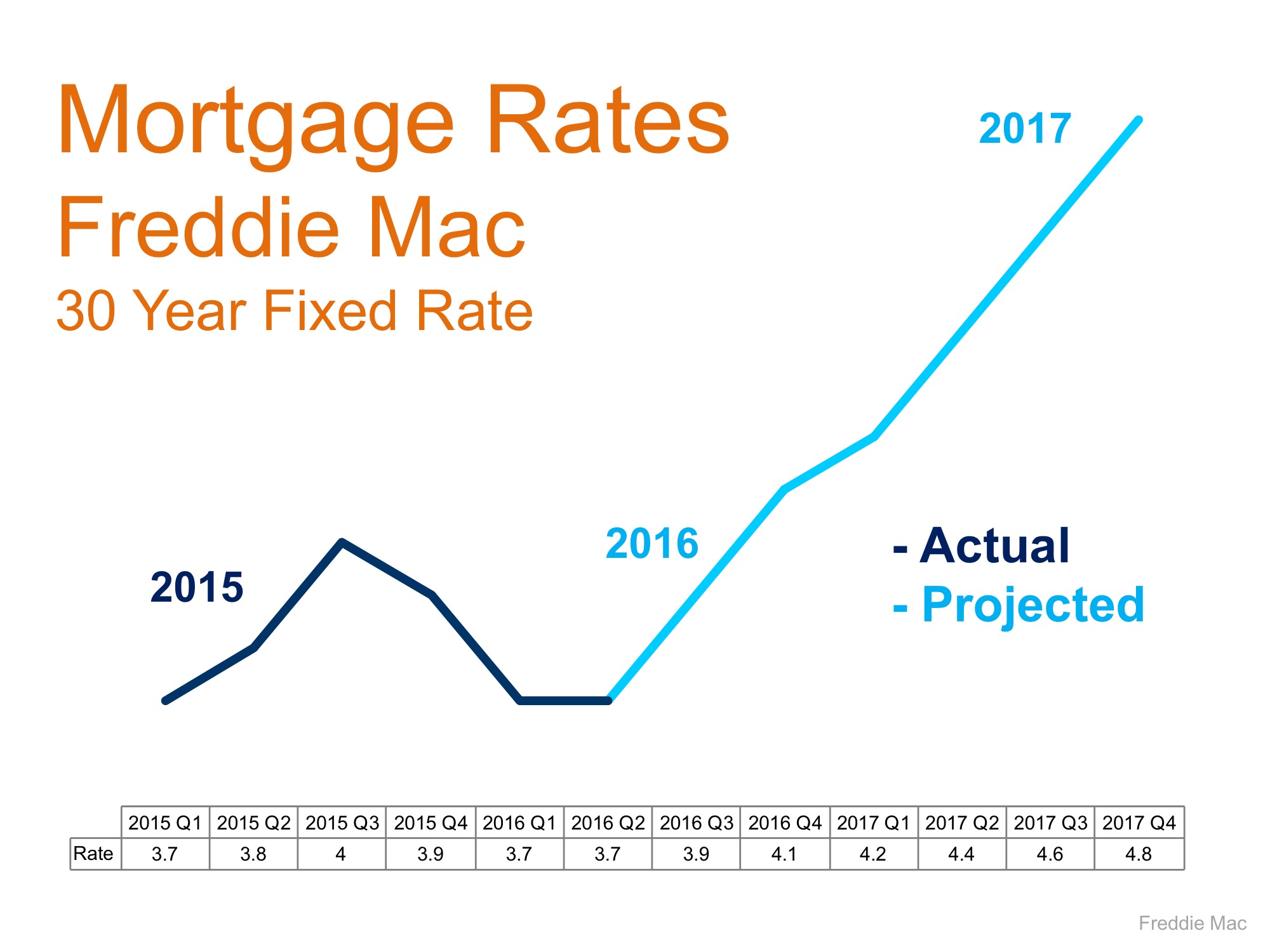

For a truly investment standpoint, financing is the way to go so that you can leverage your money at today’s low interest rates. This will also enable you to afford to buy more investment properties. However, lenders have a limit on the number of homes you can purchase as investment before they start charging you a higher rate.

Cash Advantage

A cash purchase true advantage is in negotiating in a multiple bid situation. Seller’s prefer cash offers if all other things are equal. There is no guarantee, but some seller’s will even pick your cash offer if it is a few thousand less than a financing offer.

The other advantage with a cash offer is there are some properties you can’t get financing for. These are properties that need a true rehab professional or a trusted bid from a contractor because they need so much work.

Tip: Don’t forget even if you buy it for cash, there is potential for you to refinance and get up to 75% of your cash out of the property (depending on what current loan programs are available). So you can use the strong negotiating tactic of a cash offer and then convert it to a financed property after closing.

Please contact us if you have any questions or want to start looking at property.

Leave A Comment