What is so great about Jacksonville FHA Mortgages?

Posted by Carey Frankel on

FHA Mortgage in Jacksonville May Start the End of The Current Real Estate Dip

What is the FHA?

FHA stands for the Federal Housing Administration. The FHA actually doesn't make the loan but insures the loan to the lender who is loaning the money. Since the lender is being insured against loosing their money they are able to offer FHA borrowers easier qualifying terms and lower down payment requirements.

Low Down Payment

As a FHA Borrower you can work with as little as 3% down. What is great is this 3% can come as a "gift" from family, non-profit charities and even an employer.

Don't Have Great Credit? That's OK

The purpose of the FHA is to increase housing ownership. So often borrowers who can't qualify for a conventional loan can…

3411 Views, 0 Comments

Not only do you get a loan with just 3.5% down but you will also be able to save around $10,000 over the life of the loan if you attend classes from the Homeowners Armed with Knowledge (HAWK) program before shopping for your home.

Not only do you get a loan with just 3.5% down but you will also be able to save around $10,000 over the life of the loan if you attend classes from the Homeowners Armed with Knowledge (HAWK) program before shopping for your home.

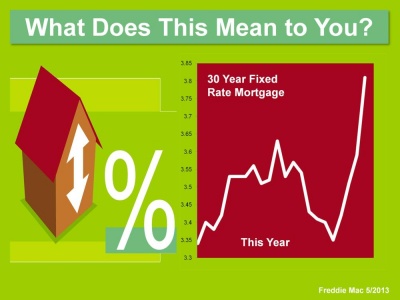

The vacillation of the stock market is being seen in the mortgage market in their rates, terms and timing.

You've probably heard that lenders have been strengthening their guidelines requiring higher credit scores for the best rates and/or bigger down payments from borrowers.

You might of heard that lender are changing their programs more regularly. But have you heard of buyers going to the closing table and the lender no longer keeping to the terms that were offered? I am being told that it is happening.

In addition, I am just being told that the rates the lenders are charging can change up to 4 times a day! So if your mortgage broker calls you with a great rate and you don't lock in ... you can pretty much be assured that the…

The vacillation of the stock market is being seen in the mortgage market in their rates, terms and timing.

You've probably heard that lenders have been strengthening their guidelines requiring higher credit scores for the best rates and/or bigger down payments from borrowers.

You might of heard that lender are changing their programs more regularly. But have you heard of buyers going to the closing table and the lender no longer keeping to the terms that were offered? I am being told that it is happening.

In addition, I am just being told that the rates the lenders are charging can change up to 4 times a day! So if your mortgage broker calls you with a great rate and you don't lock in ... you can pretty much be assured that the…