What is happening in the real estate market right now?

- The market is still moving with Buyers buying and Homes selling

- There are less Buyers and Sellers in the market resulting in a net lower sales volume

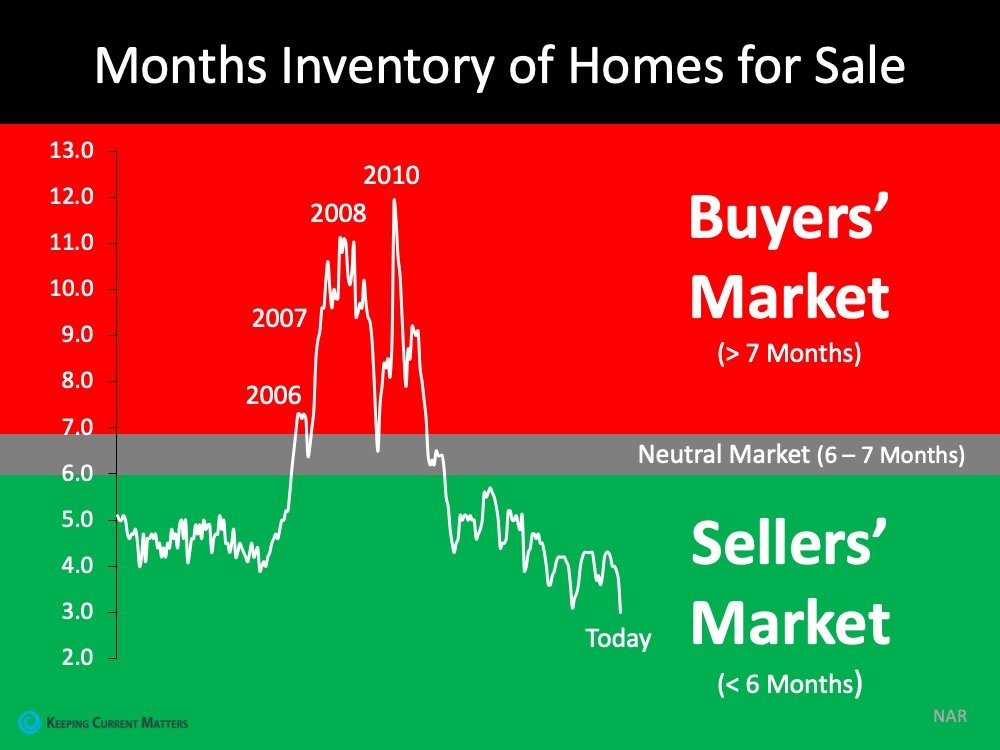

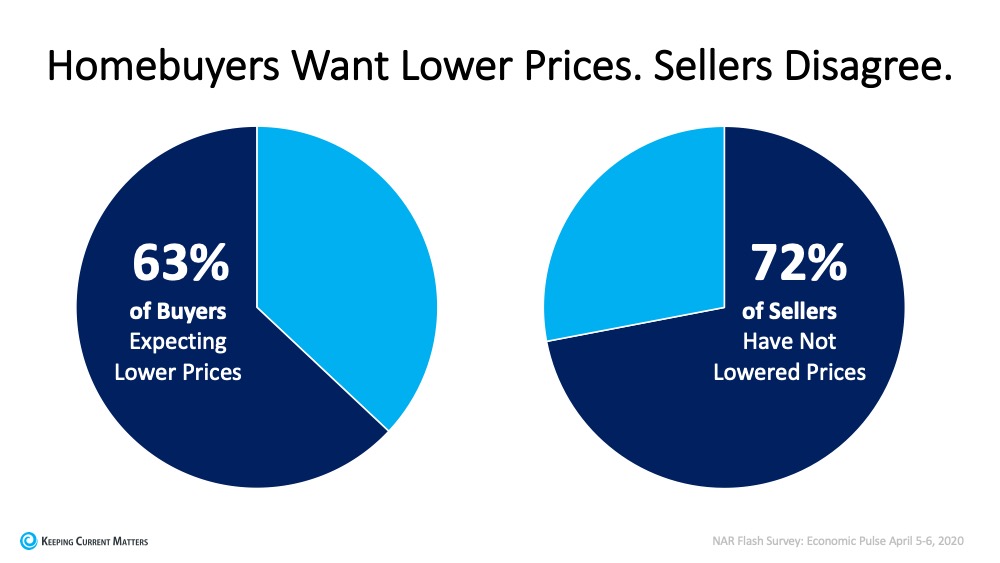

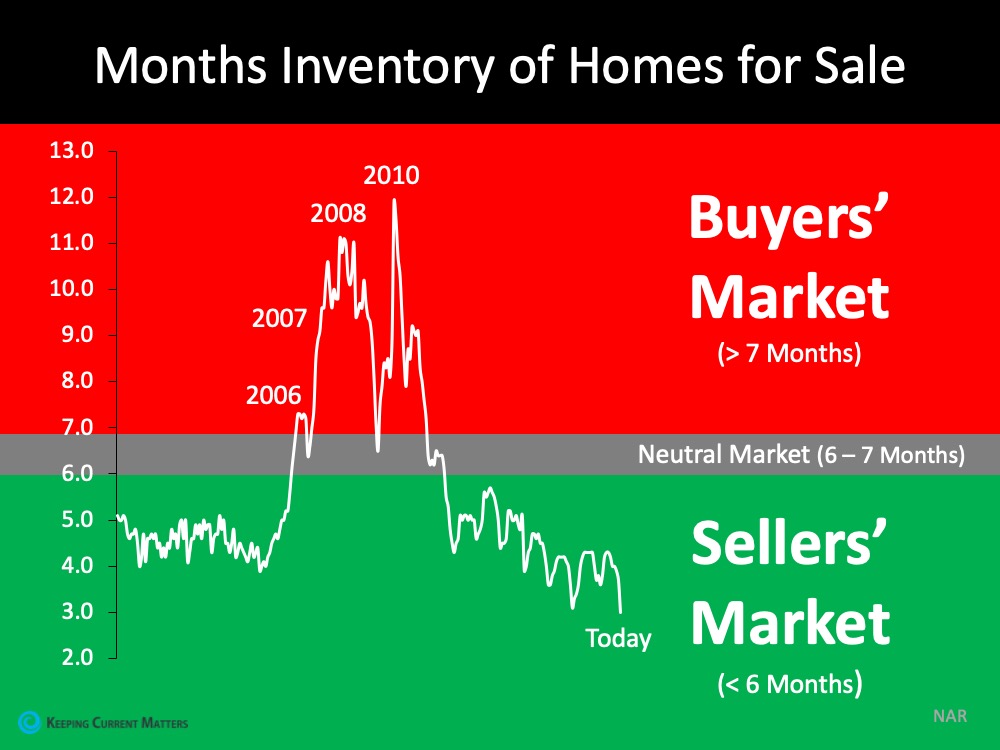

- Before the change in the market there were less Sellers than Buyers. This is still the case for now. This has led to prices not being dropped on listings yet, even though there is less Buyer activity.

- Chief Economist of NAR still forecast a rise in price

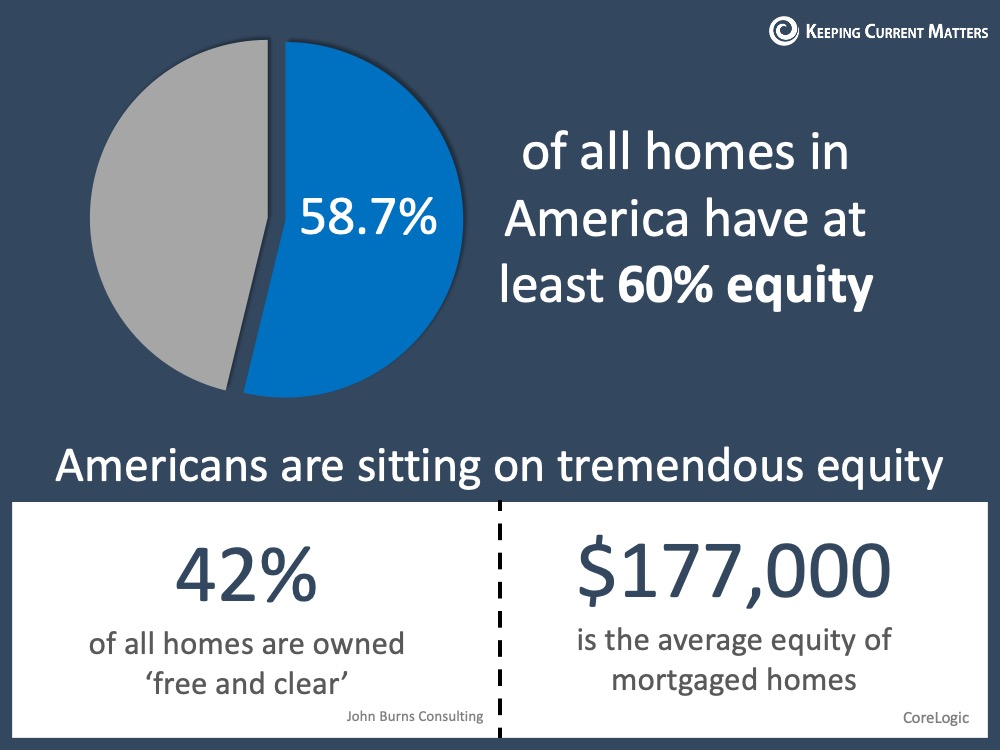

- Don't expect a foreclosure wave due to unemployment with the government's $2 trillion relief package allowed all homeowners with federally backed mortgages to be eligible for up to one year of forbearance (not making a mortgage payment).

- We expect lending to take longer while the "while the stay in place" ordinance is in effect

- Online services are being used more often. With phone video showings (ie facetime, zoom, etc) of your Realtor at the listing and you watching from your own home

- Sellers asking the Buyers to only physically look at homes if they have to move immediately (ie 30-90 days)

- A recession is expected to happen and will last 6 - 18 months. However, current job loss is expected to be temporary.

According to the most recent NAR Flash Survey (a survey of real estate agents from across the country), agents were asked the following two questions:

Ivy Zelman, President, Zelman & Associates

“Supported by our analysis of home price dynamics through cycles and other periods of economic and housing disruption, we expect home price appreciation to decelerate from current levels in 2020, though easily remain in positive territory year over year given the beneficial factors of record-low inventories & a historically-low interest rate environment.”

“The fiscal stimulus provided by the CARES Act will mute the impact that the economic shock has on house prices. Additionally, forbearance and foreclosure mitigation programs will limit the fire sale contagion effect on house prices. We forecast house prices to fall 0.5 percentage points over the next four quarters. Two forces prevent a collapse in house prices. First, as we indicated in our earlier research report, U.S. housing markets face a large supply deficit. Second, population growth and pent up household formations provide a tailwind to housing demand. Price growth accelerates back towards a long-run trend of between 2 and 3% per year.”

Mark Fleming, Chief Economist, First American

“The housing supply remains at historically low levels, so house price growth is likely to slow, but it’s unlikely to go negative.”

What We Do Know Now

The charts below are based on month end numbers and are live:

Where are real estate prices headed? See below if there is an upward or downward trend:

Are Buyers buying homes at a lower price? See below if there is an upward or downward trend.

Are homes still coming on the market? Look below for an upward or downward trend.

Are Buyers still looking at homes? See below for an upward or downward trend.

Are people still buying homes? See below for an upward or downward trend.

When the shelter in place order is ended what will happen next in the real estate market?

-

A major factor will be availability of financing due to loss of jobs, loss of savings, higher credit standards.

-

Economic hardship will lead to more homes being put on the market than pre-coronavirus. But no telling how many.

-

Potential for good investments for an investor to rent to anybody who sells their home due to economic hardship

So I would expect anyone who was severely effected by the economic downturn to put their home on the market at a price to sell quickly. So there may be a surge of well priced homes that will be quickly snapped up by the market. Once these filter out of the market then we would go back to a more normal market. In fact, we may see a very strong market for sellers due to the low supply of homes before this event.

As a side note, it looks like Buyers are loosing their fear of covid-19 as we have seen an uptick in showings as of 4/22/20. “The decline has stopped,” said ShowingTime Chief Analytics Officer Daniil Cherkasskiy. “Showings are rebounding. Our data indicates they continue to increase across the board, jumping 39 percent from two weeks ago, which represents the largest increase since the onset of COVID-19,” he added"

When will the economy bounce back?

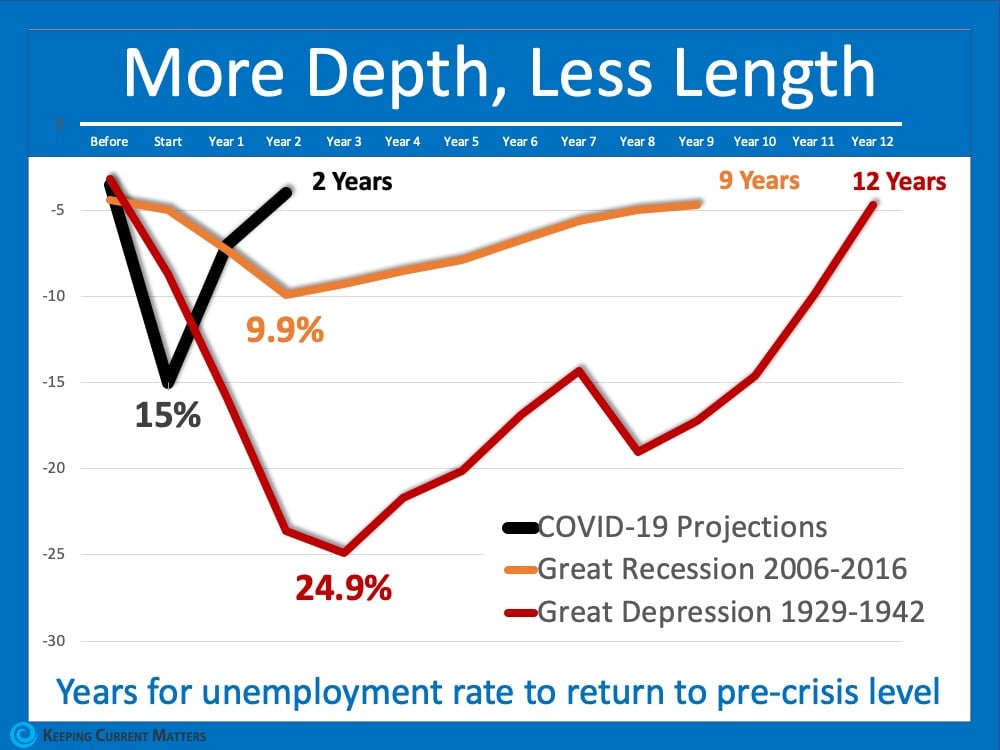

How deep will the pain cut?

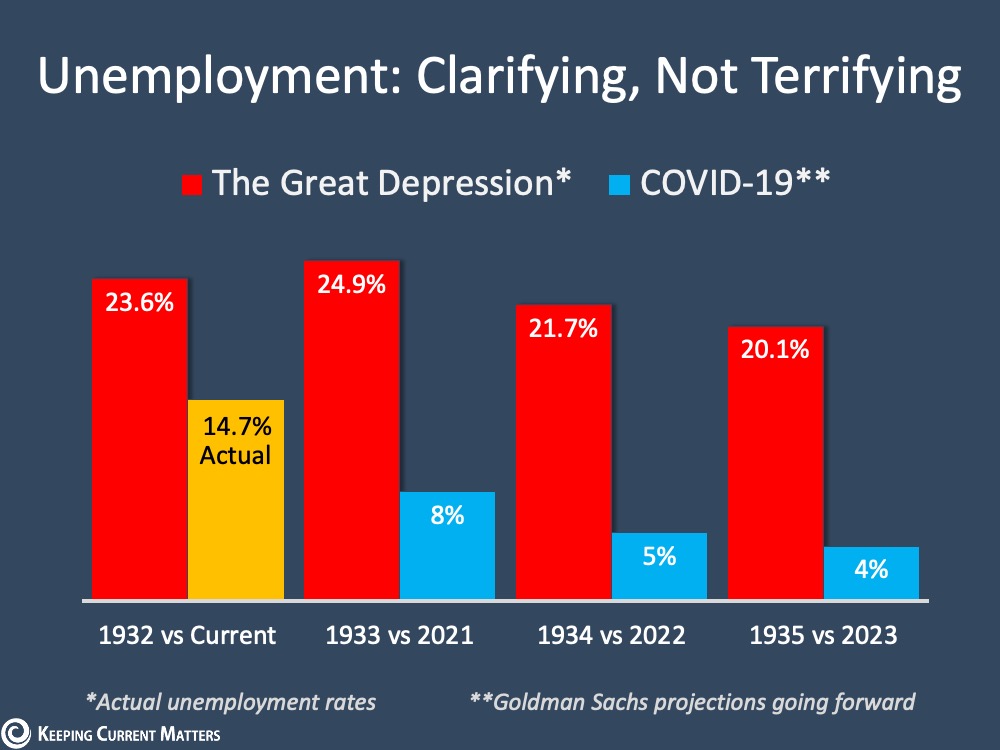

Major institutions are forecasting unemployment rates last seen during the Great Depression. Here are a few projections:

- Goldman Sachs – 15%

- Merrill Lynch – 10.6%

- JP Morgan – 8.5%

- Wells Fargo – 7.3%

How long will the pain last?

As horrific as those numbers are, there is some good news. The pain will be deep, but it won’t last as long as it did after previous crises. Taking the direst projection from Goldman Sachs, we can see that 15% unemployment quickly drops to 6-8% as we head into next year, continues to drop, and then returns to about 4% in 2023.

When we compare that to the length of time it took to get back to work during both the Great Recession (9 years long) and the Great Depression (12 years long), we can see how the current timetable is much more favorable

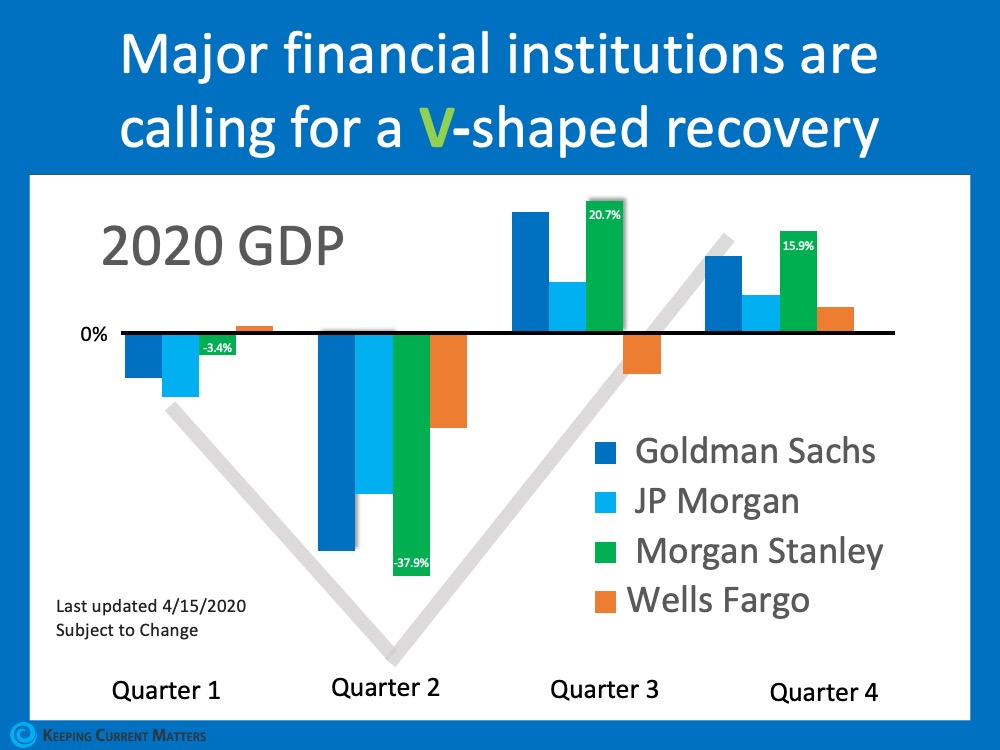

What type of recovery will we see this time?

No one can answer this question with one hundred percent certainty. However, most top financial services firms are calling for a V-shaped recovery. Goldman Sachs, Morgan Stanley, Wells Fargo Securities, and JP Morgan have all recently come out with projections that call for GDP to take a deep dive in the first half of the year but have a strong comeback in the second half. That being said, as time goes on these estimates may change.

Is there any research on recovery following a pandemic?

There have been two extensive studies done that look at how an economy has recovered from a pandemic in the past. Here are the conclusions they reached:

1. John Burns Consulting:

“Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices), and some very cutting-edge search engine analysis by our Information Management team showed the current slowdown is playing out similarly thus far.”

2. Harvard Business Review:

“It’s worth looking back at history to place the potential impact path of Covid-19 empirically. In fact, V-shapes monopolize the empirical landscape of prior shocks, including epidemics such as SARS, the 1968 H3N2 (“Hong Kong”) flu, 1958 H2N2 (“Asian”) flu, and 1918 Spanish flu.”

The research says we should experience a V-shaped recovery.

Does everyone agree it will be a ‘V’?

No. Some are concerned that, even when businesses are fully operational, the American public may be reluctant to jump right back in. The return to a more normal economy can take 6 to 18 months.

As Market Business News explains:

“In a typical V-shaped recovery, there is a huge shift in economic activity after the downturn and the trough. Growing consumer demand and spending drive the massive shift in economic activity.”

If consumer demand and spending do not come back as quickly as most expect it will, we may be heading for a U-shaped recovery.

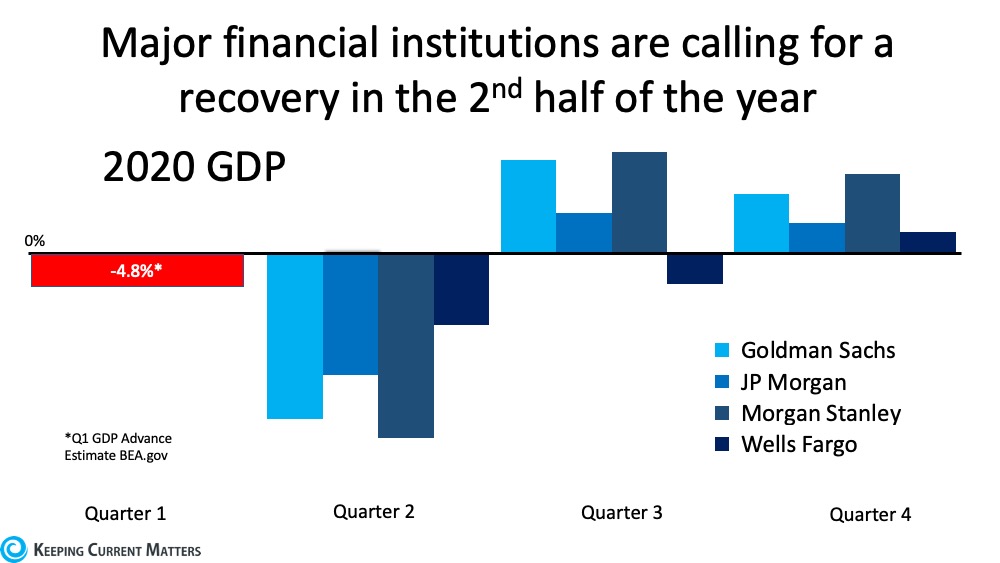

In a message last Thursday, Chris Hyzy, Chief Investment Officer for Merrill and Bank of America Private Bank, agrees with other analysts who are expecting a resurgence in the economy later this year:

“We’re forecasting real economic growth of 30% for the U.S. in the 4th quarter of this year and 6.1% in 2021.”

His projection, however, calls for a U-shaped recovery based on concerns that consumers may not rush back in:

“After the steep plunge and bottoming out, a ‘U-shaped’ recovery should begin as consumer confidence slowly returns.”

There is no crystal ball but "major financial institutions are calling for a recovery in the 2nd half of the year". That's right Goldman Sachs, JP Morgan and Morgan Stanley all think we will be back to a more even keel in the 3rd quarter.

Is this the 2008 real estate recession all over again?

Here are 5 essential ways this real estate market is different than 2008

-

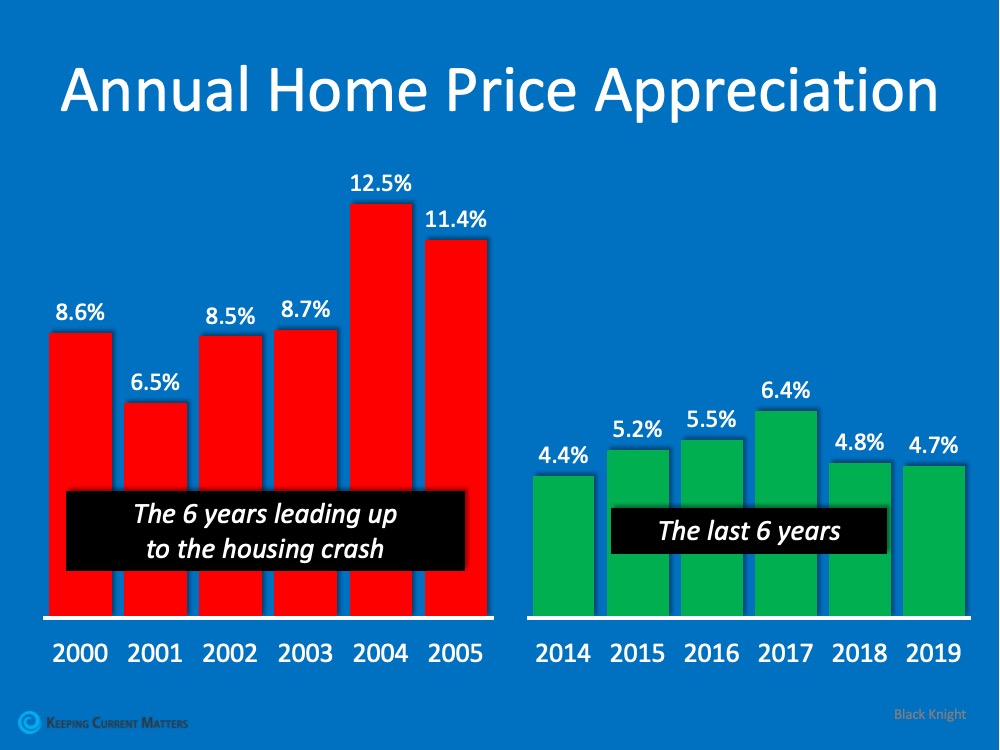

Appreciation

-

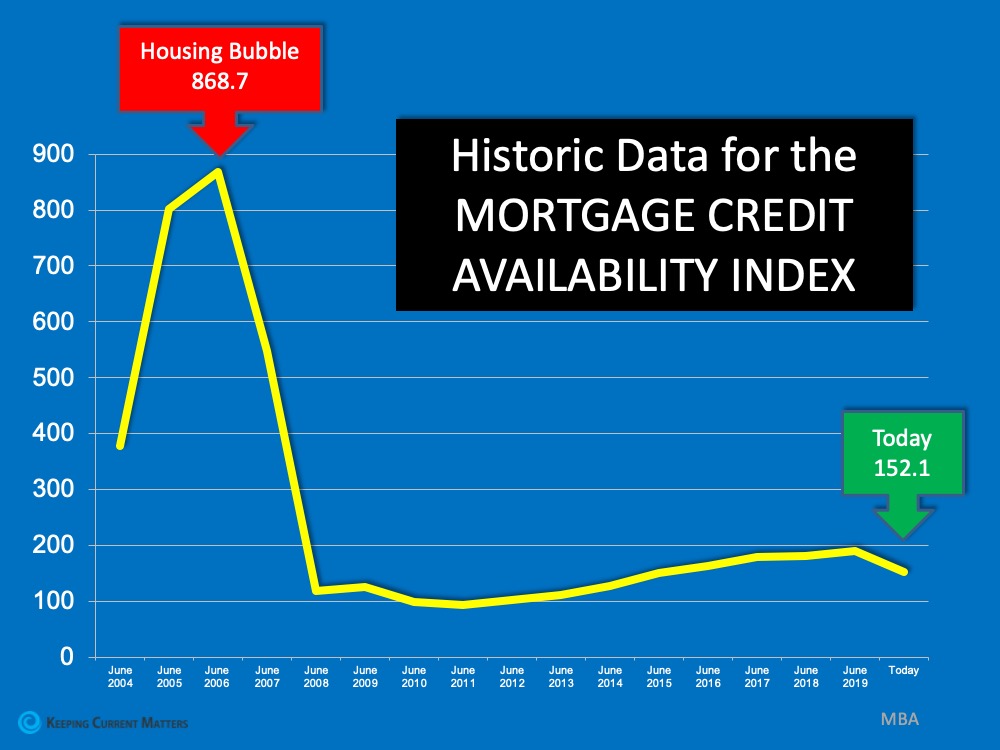

Mortgage Credit

3. Number of Homes for Sale

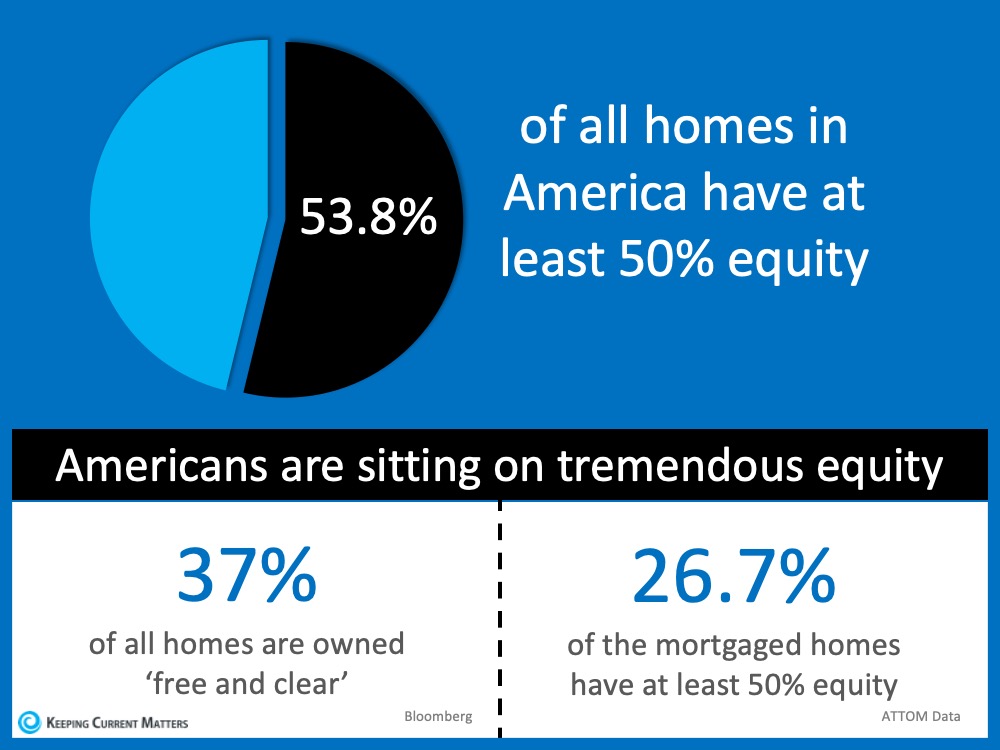

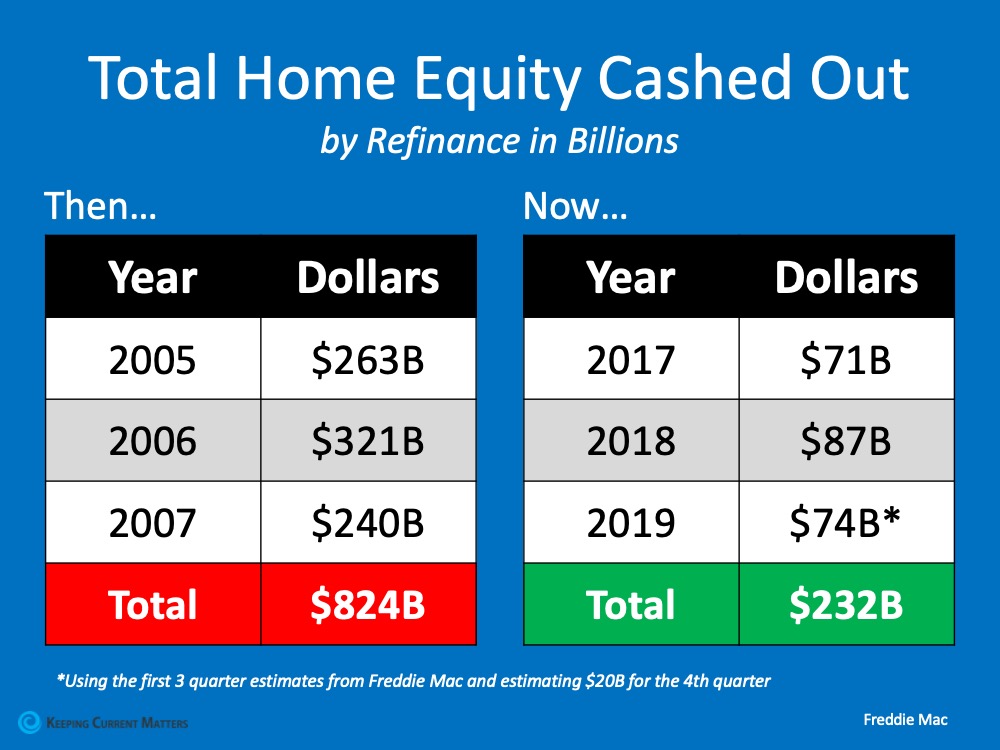

4. Use of Home Equity

5. Home Equity Today

But won't the current recession effect real estate prices?

What are the experts saying this time? This is what three economic leaders are saying about the housing connection to this recession:

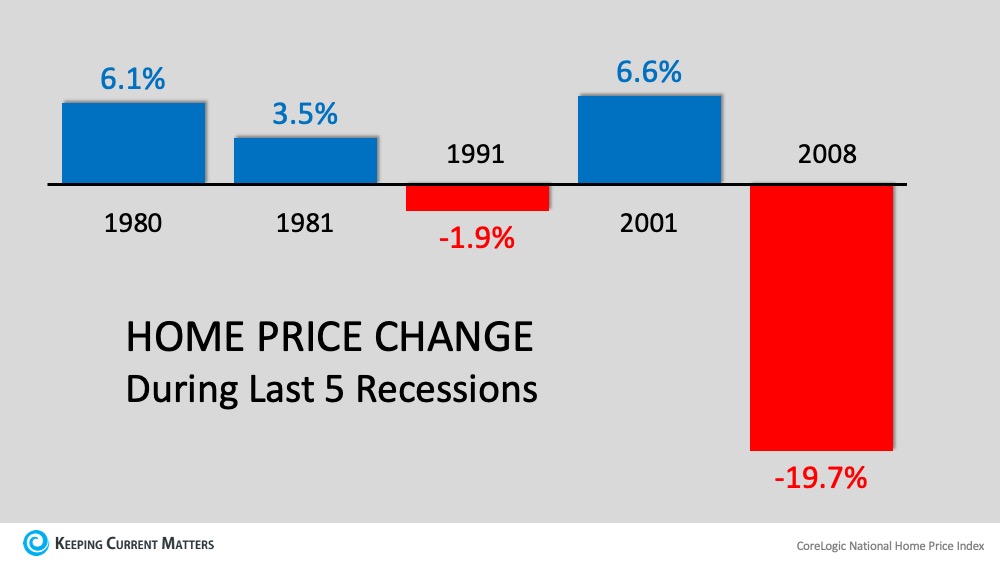

Doug Brien, CEO of Mynd Property Management, explains: “With the exception of two recessions, the Great Recession from 2007-2009, & the Gulf War recession from 1990-1991, no other recessions have impacted the U.S. housing market, according to Freddie Mac Home Price Index data collected from 1975 to 2018.”

So Should I buy a home during this pandemic and recession?

There are some positive aspects to buying a home:

- Prices won't be rising like they have the past few years. So you are more likely to get a better deal.

- Mortgage rates are low. So your payments will be lower than during normal times.

- Less competition from other buyers and the potential to get a "sweeter" deal from sellers.

However, you should only consider buying during a recession if your confident about your long term employment prospects and have a good amount of savings.

Should I sell my house during this pandemic and recession?

If you need to sell your house then you should sell it. It will take 1-2 years to get past this to a more normalized market. So there is no use in waiting if you have to sell.

The good news is homes are still selling and there is less competition on the market. Additional good news is we haven't see a drop in prices yet. So my recommendation is if you have to sell then start selling now! Real estate values are slow moving. So act before we see any changes.

Expert believe with the hit the stock market took that we will see a bigger impact in values on luxury and vacation homes.

However, you have to adjust to less showings and it taking longer to sell your home.

And you want to remain safe when selling your home. Can you take strangers coming into your home? Your Realtor already has policy and procedures to limit buyers who enter your home to the most highly qualified and to only people making the buying decision. That being said, if you have another place to live while selling that would definitely be safer. If not, then you should have a cleaning procedure after every showing.

- Provide hand sanitizer at the entry

- If you have gloves then provide those

- If you have masks then provide those

- Clean door knobs, cabinet pulls and light switches after the showing

Unique selling propositions

While limiting the amount of showings decreases your chances of selling and definitely increases your time on the market you can try some of the following:

- Showings in a tight time period. You are going to want to step out of the home if you working there. So you might limit showings from 10am - 2pm with 24 hour notice. This will give you time to plan your schedule.

- No showings until an offer. Advertise you will only allow showings with accepted offers whih are contingent on interior inspections by the buyer.

A note for investors: If you are trying to sell your investment property and it is tenant occupied then you will probably run into a problem with showings. Tenants have always been on average difficult to work with on showings. In this current epidemic that has been turned up a notch.

Other Experts Words

From the Managing Editor at Home Light regarding a polling of Realtors around the U.S.:

Since the beginning of April, there hasn’t been much change in how agents’ businesses are faring.

The majority of agents still have work to do and clients coming are to them for help, just at a slower pace than is typical:

- 67% of agents describe business as slower than normal but still doing deals

- 13% say their business has come screeching to a halt

- 12% describe their business as steady or about the same as before the pandemic

- 8% say their business is actually growing despite current circumstances

- Only 0.5% say their business is on hold for now / they’ve deliberately stepped out of the market

Reports of a “seller’s market” held steady this week but are still down from March and February.

- April 15: 48% said it was a seller’s market

- April 1: 49%

- March: 64%

- February: 77%

The overall drop in seller activity appears to be slowing.

- April 15: 78% said they’ve seen seller activity decline

- April 1: 76%

- March: 41%

The percent of agents who’ve said they’ve seen sellers take their homes off the market increased but only slightly.

- April 15: 63% said they’ve seen sellers take their home off the market

- April 1: 66%

- March: 22%

The overall drop in buyer activity also appears to be leveling off.

- April 15: 74%

- April 1: 78%

- March: 45%

The percent of agents who’ve said they’ve seen buyers pause their home search also held steady.

- April 15: 84%

- April 1: 87%

- March: 52%

While the vast majority of agents have seen some drop in real estate activity on both the buy and sell sides, over half of buyers and sellers appear to be carrying on.

Meanwhile, buyers appear to be dropping out at a slightly higher rate than sellers, but not by much. On average across markets, agents estimate that:

- 37% of sellers in their market have dropped out

- 43% of buyers in their market have dropped out

As people look for ways to buy and sell safely while still practicing social distancing, the demand for virtual showings spiked again.

- April 15: 73% of agents have seen an increase in the demand for virtual showings

- April 1: 54%

- March: 20%

Over half of agents believe we’re already in a recession or will hit a recession before the end of 2020.

- April 15:

30% say we’re already in a recession; 23% say we’ll hit a recession before the end of 2020 - March:

40% said we’ll hit a recession before the end of 2020 - November 2019:

12% said we’ll hit a recession before the end of 2020

But agent optimism has actually bounced back a bit since March.

- April 15:

64% are extremely or somewhat optimistic about the 2020 housing market - March:

56% were extremely or somewhat optimistic about the 2020 housing market - November:

76% were extremely or somewhat optimistic about the 2020 housing market

As far as how agents are adapting to the coronavirus…

The biggest change we saw over the past two weeks was an increase in those doubling down on virtual tours:

- 84% have shut down open houses.

- 68% are leaning into e-signature and digital closing tools.

- 66% are doubling down on virtual tours (up from 55% April 1).

- 59% are replacing in-person client meetings with virtual ones.

- 56% are working with inspectors to implement new safety protocols around property inspections.

- 46% are restricting or eliminating physical showings.

- 31% are adapting to alternative appraisal methods for their clients.

*Respondents were surveyed between April 15-16, 2020, with 382 real estate agents participating nationwide.

The 2 Big Unknowns In My Mind

How is Real estate reacting to the corona virus?

The New Normal in the Real Estate World

Companies, realtors, buyers and sellers all have their own ideas of the policies and procedures that need to be implemented to keep everybody safe in this Corona Virus Covid-19 environment. Nobody wants to get sick. Nobody wants to get sued for getting somebody sick.

So we are seeing the steps being taken as a "work in progress". What is instituted today might not be true 3-4 months down the road.

Is it safe to buy or sell a home right now?

Contagion is Still Possible in the Real Estate Process

What we can see for sure is that the real estate process still involves for a buyer going into a strangers home who might be contagious and for a seller having strangers who might be contagious come into your home. As a realtor we have virtual tours, 3d tours, professional photography, etc that doesn't make the home tour absolutely necessary. But we are still seeing buyers wanting to physically look at homes and take the risks.

How is the corona virus covid-19 effecting the real estate transaction?

Expect Real Estate Delays

Everybody is working from home. And some departments are half staffed. So we are concerned about how quickly lending can be done. So we suggest leaving yourself some leeway at closing and expect the other party may be doing the same. What this means is if you are buying you may not want your lease or closing date of your home to match the closing date of your purchase. Instead you might want to have extra time in your current property just in case there is a delay. Or if you are selling then you might ask for a post closing occupancy to give you extra time just in case there is an issue with your purchase.

However, there are more issues. What if the buyer, seller, lender, closer, etc become subject to quarantine or closure? What if buyer looses income or job due to the virus and/or quarantine? We at the Phyllis Frankel Realty Group have an addendum to cover these issues. You should make sure you have one and use it also.

How do I keep myself safe during a real estate transaction?

Going Online for Real Estate When Possible

- Home Shopping - Buyers are doing as much of their home viewing online before making an appointment to personal view. Sellers are doing virtual tours, 3D tours, virtual open houses and more.

- Home Showing - Only for pre-approved buyers with only buyers that are buying now. No children or friends accompanying on the showings. If the buyer prefers then the Realtor can do a facetime or similar app to do a walk through of the home for the Buyer without them visiting the house.

- Contracts - All contracts can be signed via an esign service on your phone or computer.

- Closing - Some lenders and closers are set up for online closing. However, most still require you to come in and sign. The other party and Realtors won't be in the room with you. It will be just you and the notary.

Thinking of buying or selling in this market? Please contact us to discuss.

Leave A Comment