Rent or Buy? Information You Need to Know...

Posted by Carey Frankel on

[VIDEO]

Many people are considering whether they should rent or buy. But your monthly rent is higher than your mortgage payment if you bought a home in all of the largest metros by an average of 38%. Rents have also been rapidly rising. But if you are not worried about the cost than you should consider the wealth building factor. Homeowners net worth is over 30x greater than renters. Learn more about what were the deciding factors for people deciding whether to rent or buy.

In a recent press release, Zillow

stated that the affordability of the nation’s rental inventory is

currently much worse than affordability of the country’s home sale

inventory. The release revealed two things:

- Nationally, renters signing a lease at the…

1868 Views, 0 Comments

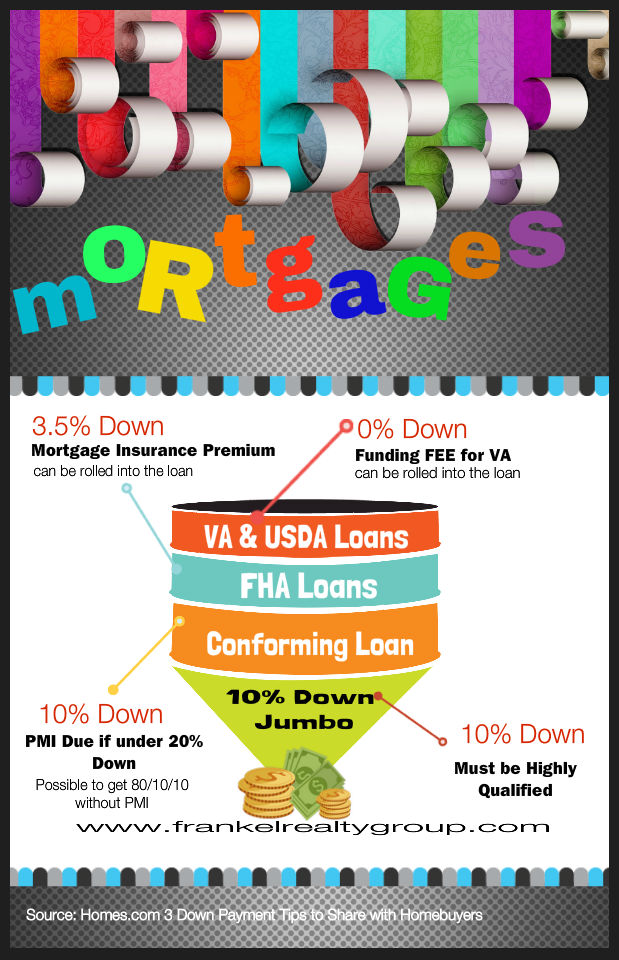

Not only do you get a loan with just 3.5% down but you will also be able to save around $10,000 over the life of the loan if you attend classes from the Homeowners Armed with Knowledge (HAWK) program before shopping for your home.

Not only do you get a loan with just 3.5% down but you will also be able to save around $10,000 over the life of the loan if you attend classes from the Homeowners Armed with Knowledge (HAWK) program before shopping for your home.

When you put your home on the market the key to selling your home is to work with your Realtor in a true partnership. What this means is you need to have open discussions with your realtor regarding their advice and the selling process. What you as a seller may consider as unimportant or not neccessary may be imperative to getting your home sold.

When you put your home on the market the key to selling your home is to work with your Realtor in a true partnership. What this means is you need to have open discussions with your realtor regarding their advice and the selling process. What you as a seller may consider as unimportant or not neccessary may be imperative to getting your home sold.